Feature

International tax cooperation: advancing equality and sustainable development

Taxation is critical to financing the SDGs. Fiscal policies can mobilize resources, reduce inequalities, contribute to macroeconomic stabilization, and create incentives for investment and sustainable production and consumption.

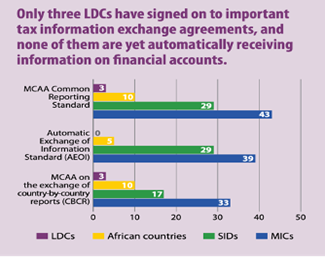

Expanding tax capacities is primarily a domestic challenge. However, globalization, financial liberalization, and digitalization have made it easier for businesses and individuals to shift profits and assets to other jurisdictions. No one country can eliminate tax evasion and avoidance on its own. Effective and inclusive international tax cooperation is critical.

International tax rules affect everyone as they shape the global economy and influence all governments’ ability to fund public services. The 2015 Addis Ababa Action Agenda sets principles for international tax cooperation to be universal in approach and scope and to fully consider the different needs and capacities of all countries.

While there has been an acceleration of international tax cooperation since 2015, existing efforts have been criticized as not responding to the needs, priorities, and capacities of developing countries.

In 2022, the Economic Commission for Africa (ECA) Conference of Finance Ministers made a clarion call for change in the global tax system, calling on UN Member States to begin negotiations for an international convention on tax matters.

In 2023, a groundbreaking initiative followed: the General Assembly decided to establish an ad hoc intergovernmental committee to draft terms of reference (ToRs) for a UN framework convention on international tax cooperation. The goal? Ensuring all countries have an equal voice in setting the international tax agenda, shaping and deciding on rules.

In August 2024, the committee adopted the draft ToRs for the framework convention. These are now with the General Assembly for consideration during its 79th Session.

This initiative represents a shift towards an inclusive, fair, and effective international tax system that addresses inequality and supports global sustainable development.

Welcome to the United Nations

Welcome to the United Nations