The current business model does not properly account for the effects of private activity on environmental and social impacts (or externalities). Companies care about environmental and social issues when these issues affect profitability, though long-term environmental and social risks are often overlooked due to the short-term nature of capital markets. And companies have for too long easily ignored those social and environmental impacts that do not affect their bottom line. As a result, the current model consumes more natural resources and creates more waste than the planet can regenerate and absorb. It also creates large social inequalities. A new model of capitalism needs to reconcile the objective of profit maximization with the societal goals of sustainable development. To be resilient, the economic system needs to rely on a business model that works for everyone, including employees, suppliers, customers, and local communities. While the exact interests of these stakeholder differ between contexts, a universal recognition that business should benefit them is what characterizes the economic system known as stakeholder capitalism. The transformation of the private sector cannot be achieved without more transparency on the impact of companies on the SDGs. In 2019, 90 per cent of S&P 500 companies published a sustainability report compared to only 20 per cent in 2011. Yet, despite the increasing number of sustainability reports, it is unclear how much behavior is changing. It remains challenging for investors and consumers to understand the environmental and social footprint of companies. Information published is often not comparable across companies or time, and tends to focus on qualitative indicators rather than on quantitative data. Companies select the issues they choose to communicate, as sustainability reporting remains largely voluntary. This creates incomplete and even misleading information.

The current business model does not properly account for the effects of private activity on environmental and social impacts (or externalities). Companies care about environmental and social issues when these issues affect profitability, though long-term environmental and social risks are often overlooked due to the short-term nature of capital markets. And companies have for too long easily ignored those social and environmental impacts that do not affect their bottom line. As a result, the current model consumes more natural resources and creates more waste than the planet can regenerate and absorb. It also creates large social inequalities. A new model of capitalism needs to reconcile the objective of profit maximization with the societal goals of sustainable development. To be resilient, the economic system needs to rely on a business model that works for everyone, including employees, suppliers, customers, and local communities. While the exact interests of these stakeholder differ between contexts, a universal recognition that business should benefit them is what characterizes the economic system known as stakeholder capitalism. The transformation of the private sector cannot be achieved without more transparency on the impact of companies on the SDGs. In 2019, 90 per cent of S&P 500 companies published a sustainability report compared to only 20 per cent in 2011. Yet, despite the increasing number of sustainability reports, it is unclear how much behavior is changing. It remains challenging for investors and consumers to understand the environmental and social footprint of companies. Information published is often not comparable across companies or time, and tends to focus on qualitative indicators rather than on quantitative data. Companies select the issues they choose to communicate, as sustainability reporting remains largely voluntary. This creates incomplete and even misleading information.

Creating a global set of sustainability reporting standards

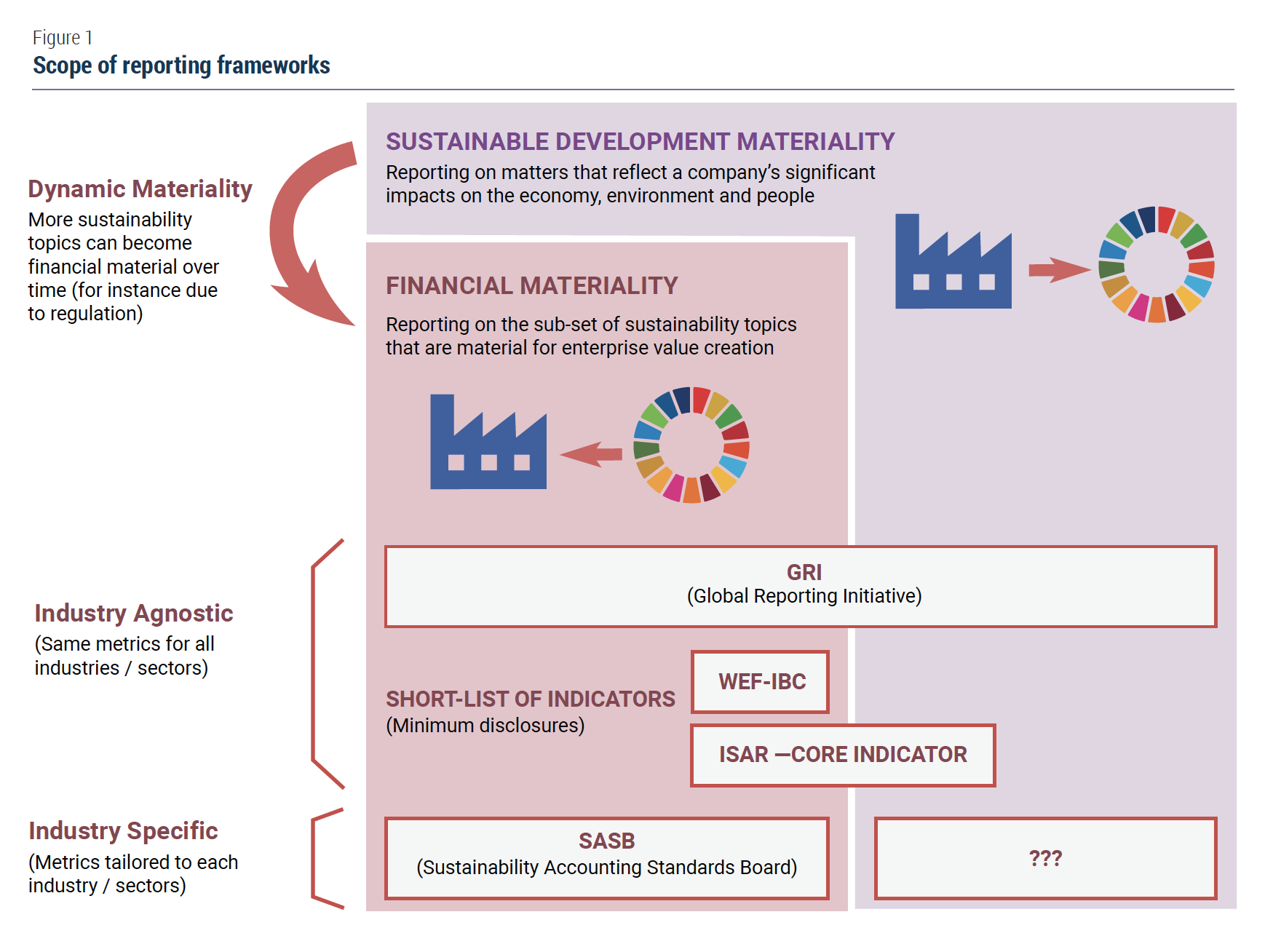

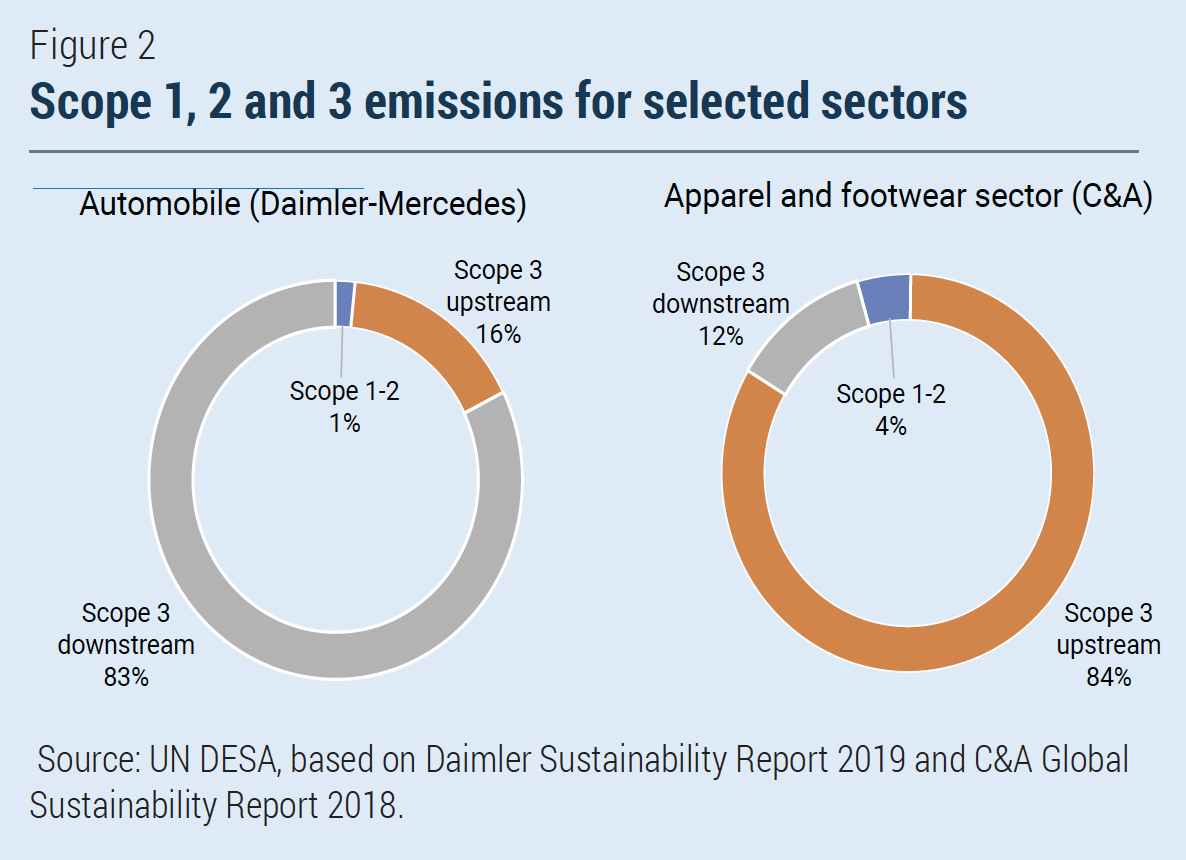

Confusion prevails over the framework companies should follow to provide sustainability-related information. Companies currently face fragmented reporting frameworks (see figure below). Companies also provide sustainability information by responding to surveys and questionnaires, including from investors, data aggregators, indices, and ratings agencies. Large companies may receive more than 100 of such queries each year. The same sustainability issue can thus be measured in many ways and reported through multiple channels depending on the framework selected and the specific questionnaire. This creates unnecessary complexity and reporting burdens for companies.  Organizations providing different reporting frameworks must consolidate their work into a single, coherent global set of reporting standards. There is already enormous traction in this area. Corporate executives and investors alike have called for reducing the number of sustainability reporting standards. The standard- setting bodies recently announced their intent to work together to address the cacophony of metrics and standards. At the same time, the International Financial Reporting Standards (IFRS) is planning the establishment of a dedicated Sustainability Standards Board within its institutional and governance structure. Since IFRS standards enjoy worldwide recognition in financial reporting, this could constitute a breakthrough. Defining the scope of sustainability reporting is as important as ensuring its harmonization. The more restrictive view is that companies should only disclose information on sustainability risks that are likely to impact their business performance (i.e., what is financially material). This level of disclosure helps financial institutions and investors in decision-making. A more comprehensive view includes disclosure on information on the external impact of company activities on environmental and social issues (what is environmental and socially material). This level of disclosure would provide meaningful information not just to those financing them, such as shareholders, but also to those they impact through their activities, including customers, employees and local communities. It is also important for “impact investors” – those investors who aim to make a positive social and environmental impact, alongside financial returns. For example, on climate change, considering a narrow or wide reporting scope implies reporting on completely different metrics (see box 1). Providing a comprehensive picture of carbon emissions might not be financially important for all businesses at this stage, but could become financially material in the future if regulations change. What is not financially material today could be so tomorrow. Changing norms – and new regulatory and policy frameworks – can shift the calculus that once distinguished financially material topics from solely environmentally and socially material ones (see the concept of dynamic materiality from figure 1). For instance, providing a comprehensive picture of carbon emissions might not be financially important for all businesses at this point in time because disclosure is voluntary and carbon taxes have not been widely adopted. However, it could become financially material in the future if regulations change and carbon emissions are taxed. In doing so, businesses need to measure their impact, account for it to stakeholders, and ultimately set targets to improve their impact over time. Harmonized, industry-specific impact metrics can provide a complete picture of a company’s sustainable development impact. Existing reporting frameworks focus on measuring the impact of company operations (how they produce). Assessing company contributions to the SDGs also requires accounting for the impact of products and services (what they produce). For example, an information technology company may provide information on its energy consumption but not on the number of people granted Internet access for the first time. This information is inherently specific to an industry and is not captured by general sector-agnostic metrics. Therefore, it would be useful to identify a list of industry-specific reporting metrics, and integrate these into existing reporting frameworks. The Global Investors for Sustainable Development (GISD) Alliance has initiated work to address this gap.

Organizations providing different reporting frameworks must consolidate their work into a single, coherent global set of reporting standards. There is already enormous traction in this area. Corporate executives and investors alike have called for reducing the number of sustainability reporting standards. The standard- setting bodies recently announced their intent to work together to address the cacophony of metrics and standards. At the same time, the International Financial Reporting Standards (IFRS) is planning the establishment of a dedicated Sustainability Standards Board within its institutional and governance structure. Since IFRS standards enjoy worldwide recognition in financial reporting, this could constitute a breakthrough. Defining the scope of sustainability reporting is as important as ensuring its harmonization. The more restrictive view is that companies should only disclose information on sustainability risks that are likely to impact their business performance (i.e., what is financially material). This level of disclosure helps financial institutions and investors in decision-making. A more comprehensive view includes disclosure on information on the external impact of company activities on environmental and social issues (what is environmental and socially material). This level of disclosure would provide meaningful information not just to those financing them, such as shareholders, but also to those they impact through their activities, including customers, employees and local communities. It is also important for “impact investors” – those investors who aim to make a positive social and environmental impact, alongside financial returns. For example, on climate change, considering a narrow or wide reporting scope implies reporting on completely different metrics (see box 1). Providing a comprehensive picture of carbon emissions might not be financially important for all businesses at this stage, but could become financially material in the future if regulations change. What is not financially material today could be so tomorrow. Changing norms – and new regulatory and policy frameworks – can shift the calculus that once distinguished financially material topics from solely environmentally and socially material ones (see the concept of dynamic materiality from figure 1). For instance, providing a comprehensive picture of carbon emissions might not be financially important for all businesses at this point in time because disclosure is voluntary and carbon taxes have not been widely adopted. However, it could become financially material in the future if regulations change and carbon emissions are taxed. In doing so, businesses need to measure their impact, account for it to stakeholders, and ultimately set targets to improve their impact over time. Harmonized, industry-specific impact metrics can provide a complete picture of a company’s sustainable development impact. Existing reporting frameworks focus on measuring the impact of company operations (how they produce). Assessing company contributions to the SDGs also requires accounting for the impact of products and services (what they produce). For example, an information technology company may provide information on its energy consumption but not on the number of people granted Internet access for the first time. This information is inherently specific to an industry and is not captured by general sector-agnostic metrics. Therefore, it would be useful to identify a list of industry-specific reporting metrics, and integrate these into existing reporting frameworks. The Global Investors for Sustainable Development (GISD) Alliance has initiated work to address this gap.

Moving to mandatory disclosure

There is widespread support in the private sector for mandatory, legally binding sustainability disclosures. Whereas in the past business leaders preferred voluntary disclosure, that view has shifted due to the proliferation of reporting standards and the increasing focus and importance of sustainability issues since the adoption of the SDGs. A survey conducted with corporate executives and investors indicated strong support for mandatory sustainability reporting for companies; 82 per cent of investors and 66 per cent of executives agree with this. Reporting frameworks are only as useful as their uptake by companies. Policymakers should make it mandatory for large companies, both listed and unlisted, to report on a core set of general metrics. Without mandatory requirements, disclosure will remain partial and non-harmonized. To this end, they could build on the two lists of core sector-agnostic metrics developed, respectively, by UNCTAD and the Economic and Social Council’s Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting (ISAR) (33 metrics) and by the World Economic Forum International Business Council (WEF-IBC) (21 core metrics and 34 expanded metrics). It would help if these initiatives, could work together towards aligning their metrics, as well as with standard-setting bodies, to converge on a globally harmonized list of core metrics. This list could then be implemented at the national level by appropriate regulatory bodies as a minimum level of corporate disclosure. On the issue of climate change, there are also calls to make reporting in line with recommendations from the FSB Task Force on Climate-related Financial Disclosures (TCFD) mandatory, as recently announced by New Zealand and the United Kingdom of Great Britain and Northern Ireland. To mitigate regulatory burden, disclosure requirements should be proportional to company size and sophistication. Large multinational companies have deep social and environment footprints, as well as the resources to assess and disclose the impact of their operations, products, and services. Imposing the same standard on small and medium-sized enterprises (SMEs), and most companies in developing countries, would not be proportional to their footprint and means. Such companies could be subject to a “disclose-or-explain” standard, similar to the “comply-or-explain” standard used in regulation: they can choose to disclose their impact or justify why they did not. The annual reporting requirements for signatories of the United Nations Global Compact present another complementary approach, where multinationals are subject to a broader array of questions while SMEs have the option to respond to a condensed version of the questionnaire. For all companies, a transitional period during which they are excluded from legal liabilities arising from the collection and disclosure of new data categories should be considered, until they become familiar with new methods.

Reinforcing international coordination

Policymakers are in the driving seat as regards to corporate sustainability reporting. Security commissions and country regulators specify the use of reporting frameworks, building on global norms. IFRS became the financial accounting standards used in more than 140 jurisdictions because they were adopted by national regulators. Stock exchanges also have a considerable influence on company disclosure. Out of 102 stock exchanges tracked by the Sustainable Stock Exchange (SSE) initiative, 24 already have mandatory ESG listing requirements (versus 8 in 2016).  International cooperation is fundamental to developing the basis of a globally coherent solution and avoiding various standards for companies and capital market fragmentation. Without international collaboration, companies may be required to follow several (possibly incoherent) sustainability reporting frameworks, depending on where they operate and where they are listed. Different initiatives have been launched to facilitate coordination across jurisdictions. The International Organization of Securities Commissions (IOSCO) decided in 2020 to establish a Sustainable Finance Task Force to improve sustainability-related disclosures made by issuers and asset managers. The International Platform on Sustainable Finance, launched in 2019, also aims to facilitate multilateral dialogue and now has 17 members representing 50 per cent of world population. These and other coordination efforts could be further brought together and advanced by leveraging the United Nations intergovernmental platforms, particularly the Financing for Development process, UNCTAD-International Standards of Accounting and Reporting (ISAR) sessions focusing on corporate reporting, and the Twenty-sixth United Nations Climate Change Conference (COP26). These platforms are well-positioned to call for a globally coherent solution aligned with the SDGs that is proportional to the means and footprints of companies in developing countries. The UN Statistics Division can also continue its work with global standard setters on aligning their reporting systems with statistical reporting requirements.

International cooperation is fundamental to developing the basis of a globally coherent solution and avoiding various standards for companies and capital market fragmentation. Without international collaboration, companies may be required to follow several (possibly incoherent) sustainability reporting frameworks, depending on where they operate and where they are listed. Different initiatives have been launched to facilitate coordination across jurisdictions. The International Organization of Securities Commissions (IOSCO) decided in 2020 to establish a Sustainable Finance Task Force to improve sustainability-related disclosures made by issuers and asset managers. The International Platform on Sustainable Finance, launched in 2019, also aims to facilitate multilateral dialogue and now has 17 members representing 50 per cent of world population. These and other coordination efforts could be further brought together and advanced by leveraging the United Nations intergovernmental platforms, particularly the Financing for Development process, UNCTAD-International Standards of Accounting and Reporting (ISAR) sessions focusing on corporate reporting, and the Twenty-sixth United Nations Climate Change Conference (COP26). These platforms are well-positioned to call for a globally coherent solution aligned with the SDGs that is proportional to the means and footprints of companies in developing countries. The UN Statistics Division can also continue its work with global standard setters on aligning their reporting systems with statistical reporting requirements.

Welcome to the United Nations

Welcome to the United Nations