Investment needs in the face of the covid-19 pandemic

Investment needs in the face of the covid-19 pandemic

The magnitude of finance and investment required to implement the 2030 Agenda for Sustainable Development is significant - trillions of dollars per year, mainly in infrastructure (power, telecommunications, transport, and water and sanitation). Finance and investment needs have grown further, as COVID-19 not only reversed years of progress on the Sustainable Development Goals (SDGs), but also revealed critical infrastructure gaps, for example in healthcare and digital connectivity. The bulk of the required investment will need to be long-term. The financing needs of infrastructure are on average over 20 years. In addition, without a long-term perspective, specific risks, such as climate risks, will not be priced into decision-making. Public resources remain significant, especially for certain uses, and there remains considerable scope to accelerate their mobilization. At the same time, it is essential to unlock opportunities for the private sector to invest in sustainable development and to better align investments and business operations with the SDGs. However, the levels of productive private investment, and especially long-term investment, have not been sufficiently channeled to areas most essential for sustainable development, such as in infrastructure, green economy and small and medium enterprises. The COVID-19 pandemic has had a dramatic dampening effect on investment. Foreign direct investment dropped by 42 per cent in 2020 compared to 2019 as restrictions were imposed in many countries, which resulted in delays on existing projects and reassessments of planned projects.

The possibilities and impediments to scaling up private investment for sustainable development – the central role of incentives

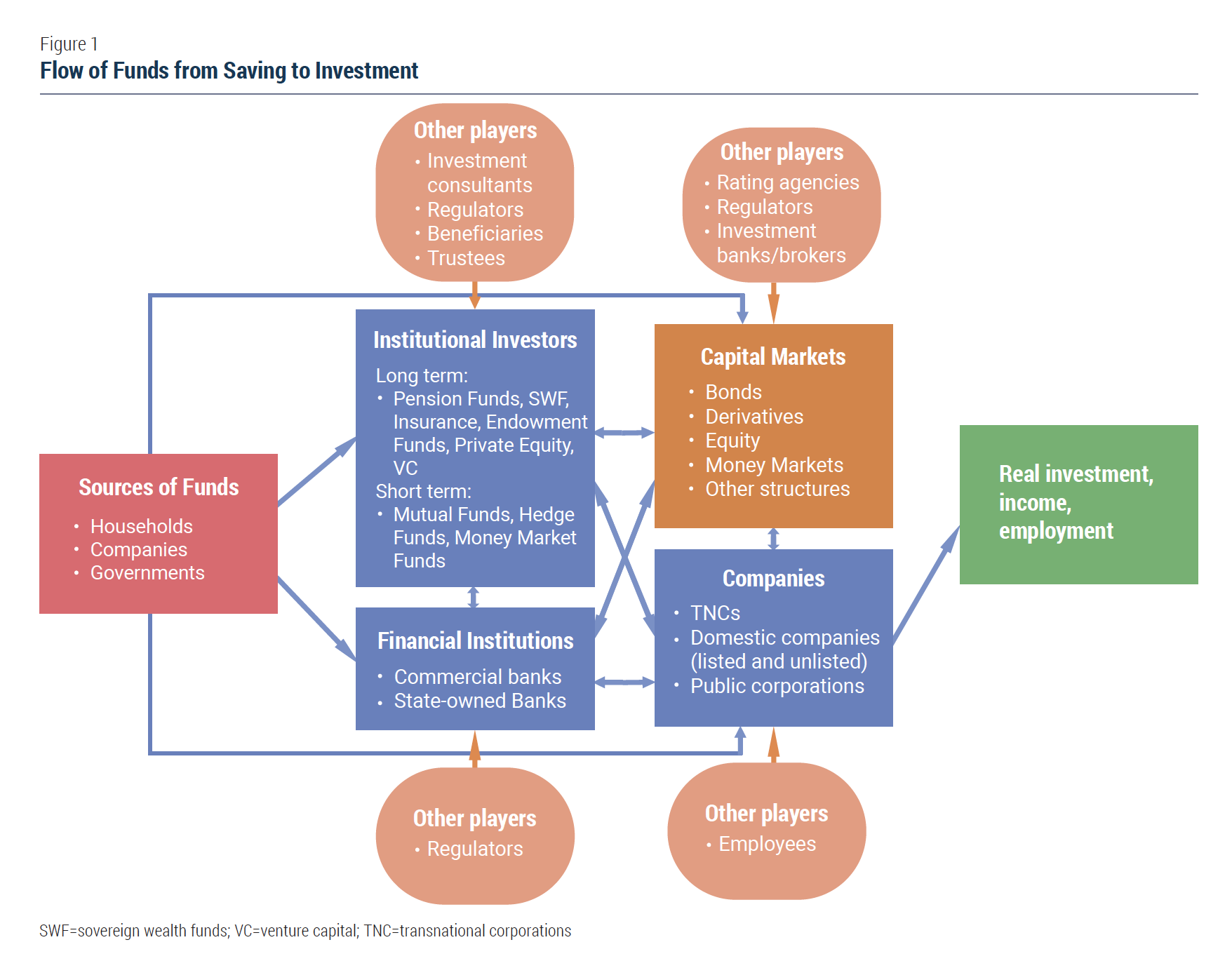

An integrated assessment of the possibilities and impediments to mobilizing long-term investment for sustainable development can be undertaken by using a flow of funds framework for analysis, from sources of funds to uses and outcome, as indicated in figure 1. According to this framework, the magnitude, time horizon and quality of investment that ultimately accrues is a function of decisions taken by key intermediaries - i.e. the suppliers of finance for longer-term investment (commercial banks, institutional investors and related capital market actors) and the direct investors (corporations – large and small, domestic and international, listed and unlisted). As will be explained, the decisions of these intermediaries are interrelated and the flow of funds through them should be viewed dynamically, where the end investment outcomes create new savings leading to another round of what is in effect a cycle.

Institutional investors

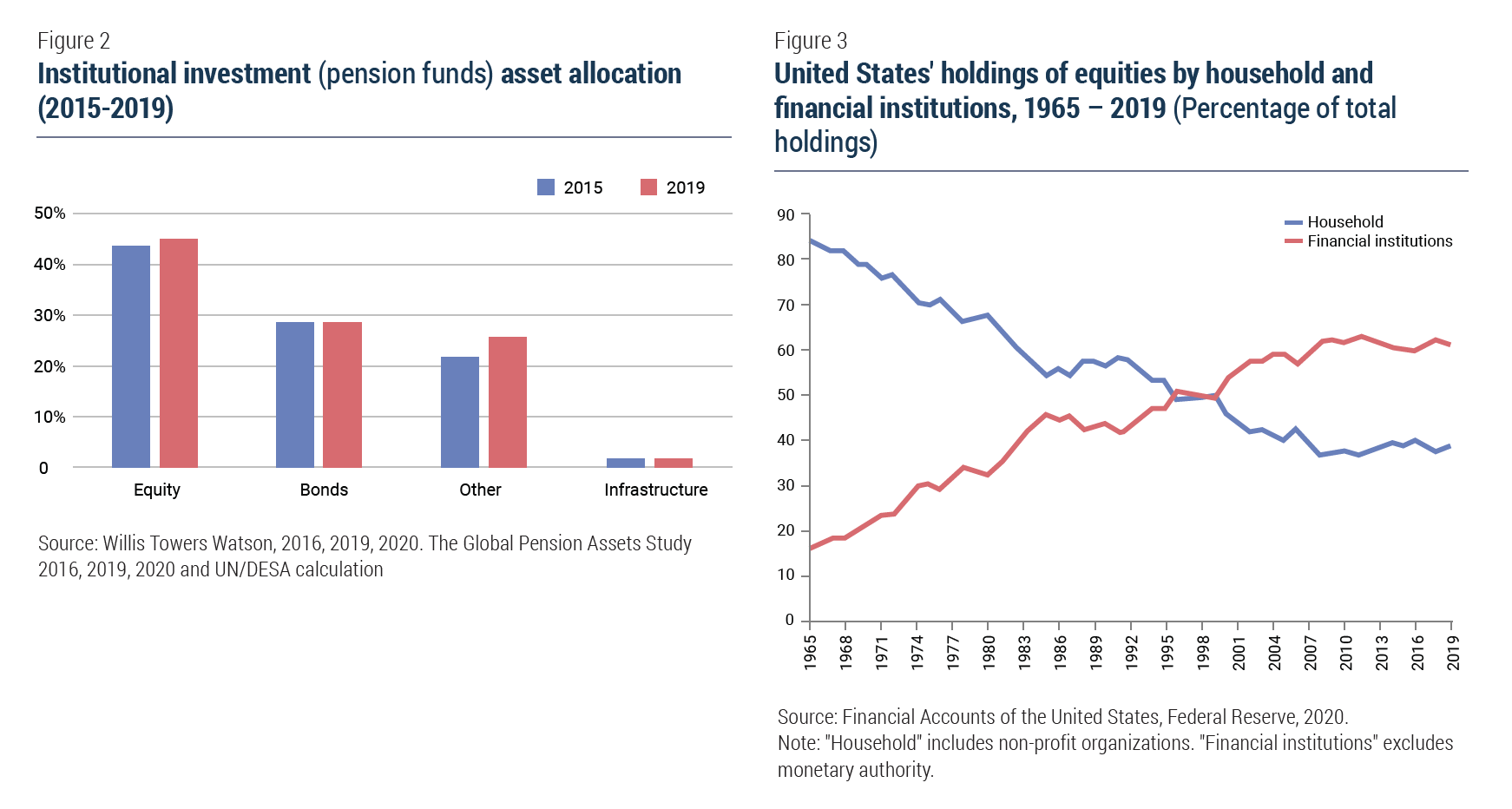

Institutional investors have been looked to as a potential source of financing for sustainable development, both because of size of assets under management, and because of long-term liabilities of some investors. Around $80 trillion in institutional investor assets are held by asset owners, such as pension funds, insurance companies, and sovereign wealth funds, with long-duration liabilities. However, only a fraction of these assets is invested in important areas for sustainable development such as infrastructure. A considerable proportion is out-sourced to professional asset managers, many of whom have shorter- term horizons. A reallocation of a small percentage of these towards investment in sustainable development could have an enormous impact. Yet a shift of even this relatively small percentage will be extremely challenging. Indeed, it is unlikely to happen without a significant shift in behaviour, led by changes in both private actions and public policies. This is because the incentives of institutional investors are not sufficiently aligned with longterm investment or with sustainable development. One reason for low investment is some areas critical for sustainable development is that the perceived risk return profiles of projects are not competitive with other investment opportunities. Other factors that constrain long term institutional investors like pension funds from investing a larger proportion of their assets in long-term SDG-related projects include fiduciary responsibilities, regulations, accounting and reporting rules, capacity and outsourcing, performance and career-based factors and institutional issues.

Other financial system actors

The incentives facing institutional investors are intertwined with incentives across key players in the financial system. While commercial banks are the sources of two-thirds of all financing globally, they have been reducing their levels of lending for infrastructure in developing countries. Additional financial actors across the investment chain - including credit rating agencies, brokers and stock exchanges - play an important role in influencing the decisions of institutional investors and banks. For instance, the time horizon for credit ratings is relatively short – between 2 and 5 years for corporate debt – and often tend to be pro-cyclical. This means that they also help institutionalize a shorter-term outlook. There is also the need to address broader issues pertaining to a sustainable financial system, including mainstreaming long-term and sustainability considerations into the regulatory framework and the decision-making process of key standard setters.

Non-financial corporations

The incentives of financial investors affect real investment decisions by non-financial corporations. For instance, there has been an expanding role of financial actors in corporate decision-making and ownership, as well as an increase in financial activities of non-financial corporations. These trends, along with quarterly reporting, have put pressure on business executives to demonstrate short-term performance. Other factors that have likely suppressed corporate long-term investment (despite record levels of profits) include a shift from private ownership to public listings, changes in technology and competition and the prevalence of stock-based pay and options.

Identifying and implementing solutions

Addressing these impediments comprehensively – and in a way that would enhance both the quantity and quality of available finance and investment for sustainable development - necessitates solutions in three interrelated areas: addressing incentives, channeling investment and enhancing impact. As part of his Strategy for Financing the 2030 Agenda for Sustainable Development, the UN Secretary- General established in October 2019 an Alliance of 30 prominent business leaders termed ‘Global Investors for Sustainable Development’ (GISD), to employ their combined expertise and influence to undertake relevant actions in the above areas. The GISD Alliance membership represents a broad range of actors along investment chain, including financial corporations as well as technology and manufacturing companies.

Addressing incentives

It would be necessary to address the incentives of the above-mentioned actors (institutional investors, banks, broader financial system actors and non-financial corporations) with a view to unblocking the obstacles to scaling up long-term finance and investment for sustainable development. Measures should focus both on addressing incentives specific to each group of actors and influencing the interrelationships between them across the investment chain. On the former, due consideration needs to be given to regulatory factors (e.g. corporate governance codes, accounting standards, financial reporting systems, fiduciary rules) and industry-specific practices (e.g. evaluation and rewarding of portfolio managers, performance benchmarks, internal performance metrics, composition of corporate boards). GISD Alliance members are engaging with policy-making and regulatory bodies on measures to better incentivise longer-term investments in sustainable development. With regard to the latter, the Alliance is working to mobilize a critical mass of asset owners, asset managers and non-financial investee corporations with a view to drawing up a ‘model mandate’ that seeks to define their relationships across the investment chain. Hence, for example, asset owners like pension funds – who tend to outsource a large amount of their funds to asset managers – can agree on terms whereby these would be engaged in longer-term sustainable investments and likewise agreements can be drawn up with non-financial investee corporations.

Channeling investment

The second area relates to channeling investment to countries and sectors most beneficial for the SDGs. Possible measures may include the development of scalable end-to-end investment opportunities; promoting innovative financing vehicles, tools and platforms (including blended finance structures) to channel sizable capital flows into sustainable investment projects; and enhancing information sharing on competitive SDG investments. Achieving this effectively and to scale would entail collaboration between governments, multilateral development banks, bilateral donors and private investors. To facilitate the channelling of investment to countries and sectors most in need, the Alliance plans to establish coordinated SDG investment platforms in cooperation with multilateral partners that will assist developing country governments in preparing a pipeline of bankable SDG-linked projects, for example in the area of sustainable infrastructure. In addition, the platforms can promote government-investor engagement, support investors with building and scaling their own investment strategies and develop blended finance instruments and funds. The aim will be to significantly scale these to attract participation from the wider universe of institutional and direct investors.

Enhancing impact

The third area relates to enhancing the impact of existing and future investment on sustainable development. Social, green or SDG-washing is a continuous challenge. Investments may be labelled as contributing to these objectives, but the real impact remains unclear or disputed. In the worst cases, the investments might be harmful. Steps to address these challenges may include supporting industry-based standards for sustainability reporting and impact measurement; developing appropriate taxonomies for companies and investors, aligning existing metrics, streamlining existing standards and initiatives; and introducing standards that implement and operationalize principles and frameworks for sustainable and impact investment. The GISD Alliance has agreed on a common definition of sustainable development investing (SDI), which provides basic criteria for investment strategies and products to qualify as being aligned with sustainable development. Including the SDI definition in investment portfolios can enable investors to make a significant contribution to the SDGs and minimize the incidence of green washing. To further enhance impact, the GISD Alliance will be supporting the development and implementation of a clear set of SDG related metrics that can be widely adopted and integrated into existing reporting frameworks. This will entail both advancing a set of industry-specific SDG-related reporting metrics that could be integrated into existing reporting frameworks and promoting reporting on, and convergence of, core-industry agnostic metrics. This would serve to provide clear feedback and information on the sustainable development impact of companies’ investment and operations.

Conclusion

The necessary actions to scale up, channel and enhance the impact of private finance for sustainable development need to be implemented at different levels: within individual firms; within respective industries; and through system-wide policy and regulatory change. These will in turn necessitate actions by both private actors, including financial institutions and corporations, and public actors, particularly governments and multilateral institutions. All these actions will need to take place in a coordinated manner for change to happen. The recovery from the COVID-19 pandemic provides a window of opportunity to initiate key reforms at various levels of the financing and investment landscape. Such changes will be essential for the achievement of the SDGs. With the GISD Alliance, the UN Secretary-General established a mechanism to enhance the momentum for engaging the private sector, as well as to leverage the transformation of the broader investment ecosystem. In addition, the GISD Alliance can make a critical contribution to the global dialogue between governments and the private sector on how to scale up investment and align private business and finance with sustainable development.

Welcome to the United Nations

Welcome to the United Nations