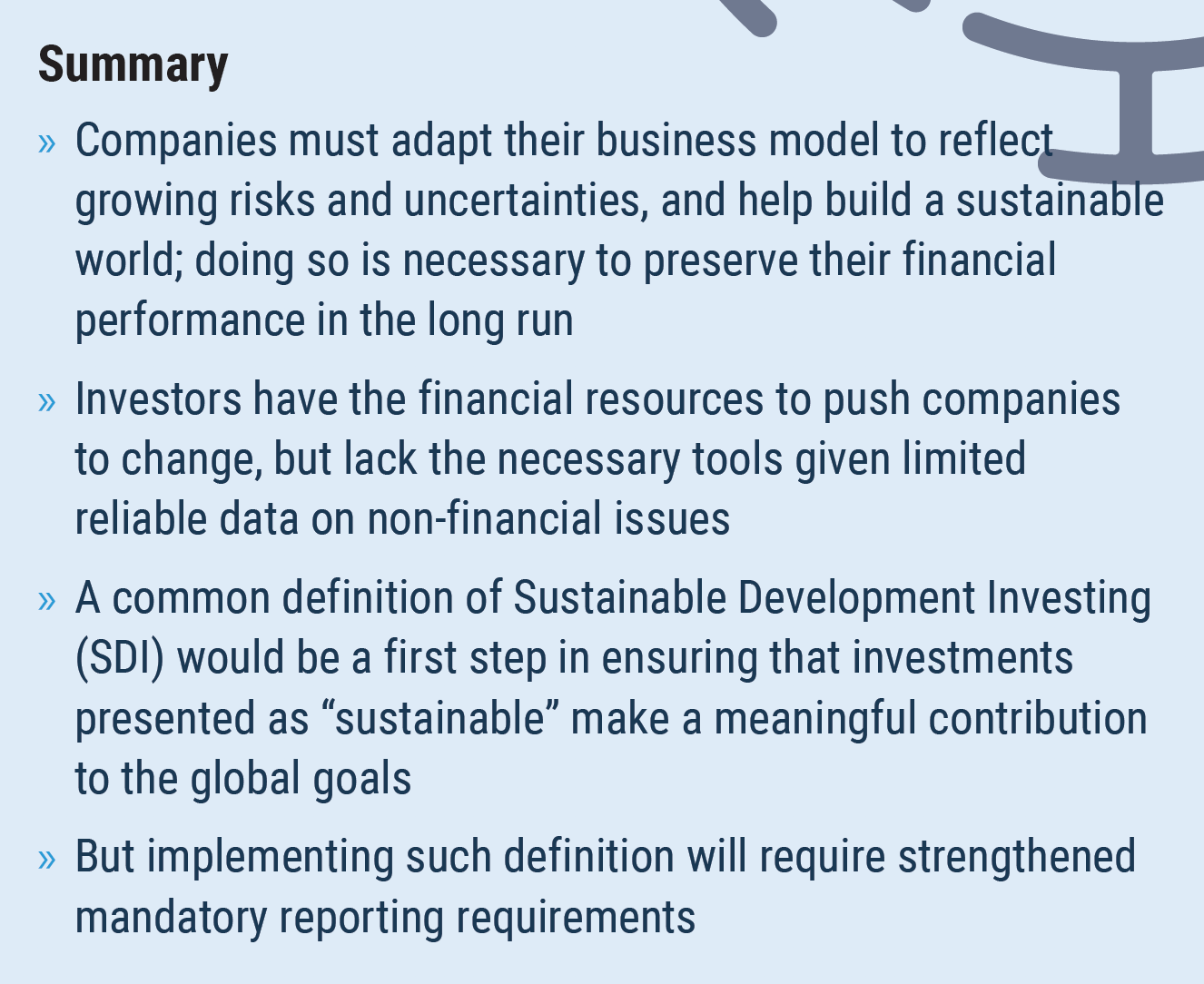

The COVID-19 crisis has highlighted the need for businesses and investors to adjust to a world of increasing uncertainty or mounting risks. To be viable, businesses can no longer focus only on short-term financial returns; they must anticipate and prepare for future risks, including growing risks from climate change and unsustainable practices. For investors, their portfolio’s financial return ultimately depends on a sustainable and stable economy. With sizeable assets under management, large investors have the interest and power to demand a shift towards business models that better account for sustainable development and thus reduce risks for the economy. The question should no longer be whether investors can beat the market in the short-term, but how they can maximize long-term financial performance. At the same time, many individuals want to use their money to support change they believe in. Every survey shows that individual investors want their money to do good in the world and have a positive impact. No one wishes to retire or live in an unlivable world. So, why are we not seeing faster progress? There has been some progress. Some asset managers have begun to respond to changing consumer demand by incorporating environmental, social, governance and other non-economic risks in their investment decisionmaking. Yet, to date, these changes have been insufficient to transform the private sector at the speed and scale required. A systemic shift is needed to make significant progress across sectors and areas where companies have an impact, such as carbon emissions, waste production and gender balance. While there are myriad of reasons for the slow progress, one important factor is that investors do not have the tools to make the investments they need—they lack information and data necessary to measure activity and hold companies accountable for their social and environmental behaviour.

The COVID-19 crisis has highlighted the need for businesses and investors to adjust to a world of increasing uncertainty or mounting risks. To be viable, businesses can no longer focus only on short-term financial returns; they must anticipate and prepare for future risks, including growing risks from climate change and unsustainable practices. For investors, their portfolio’s financial return ultimately depends on a sustainable and stable economy. With sizeable assets under management, large investors have the interest and power to demand a shift towards business models that better account for sustainable development and thus reduce risks for the economy. The question should no longer be whether investors can beat the market in the short-term, but how they can maximize long-term financial performance. At the same time, many individuals want to use their money to support change they believe in. Every survey shows that individual investors want their money to do good in the world and have a positive impact. No one wishes to retire or live in an unlivable world. So, why are we not seeing faster progress? There has been some progress. Some asset managers have begun to respond to changing consumer demand by incorporating environmental, social, governance and other non-economic risks in their investment decisionmaking. Yet, to date, these changes have been insufficient to transform the private sector at the speed and scale required. A systemic shift is needed to make significant progress across sectors and areas where companies have an impact, such as carbon emissions, waste production and gender balance. While there are myriad of reasons for the slow progress, one important factor is that investors do not have the tools to make the investments they need—they lack information and data necessary to measure activity and hold companies accountable for their social and environmental behaviour.

Put money at work in a credible way

Money is one of the most powerful ways to create change in a market economy. If private companies believe they need to be more sustainable to attract funding, they will adapt their business model accordingly. The extent of such adaption will, however, depend on the depth of sustainability interest and how strictly it is assessed. If a thin veneer of “sustainability” suffices to please investors, the change is likely to be immaterial or negligible. To date, “sustainable investments” encompass a wide range of investment strategies used by portfolio managers, with varying degrees of sustainability and impact. And some financial products and strategies are presented as sustainable without making a meaningful contribution to sustainable development, including to the achievement of the Sustainable Development Goals (SDG) (i.e., so-called green- and SDG-washing). For example, some “sustainable” funds include fossil-fuel or tobacco companies, based on their relatively good environmental, social and governance (ESG) performance compared to industry peers, while their impact on sustainable development, including climate and health, is questionable. Ensuring the credibility of sustainable investment products is critical to build trust in the industry and support demand for these products. A common definition of Sustainable Development Investing (SDI) could help establish norms that differentiate investment strategies. This definition could set minimum thresholds that investment strategies and products should meet to qualify as aligned with sustainable development. This could counter the risk of SDG-washing and misleading investment products that use sustainable development as a marketing tool. The definition could enable investors to make a significant contribution to the SDGs.

Hold companies accountable

A definition alone would not suffice because Sustainable Development Investing requires proper information on corporate sustainability practices. Investors need information to make risk-return analyses and decide on portfolio allocation. Financial reporting standards have allowed companies to speak the same language in measuring financial performance. There is a need for similar frameworks and common metrics for environmental and social impact disclosure. While sustainability reporting by companies has grown significantly over the last decade, at least three key challenges remain. First, the largely voluntary nature of sustainability reporting is problematic. Companies are generally able to decide which indicators they choose to report on. They can choose to report only on positive results and avoid communicating negative impacts. Mandatory reporting would help create a level playing field for all. The time has come to shift from voluntary to mandatory sustainability reporting. Second, the quality of sustainability reporting needs improvement. A recent study of more than 700 multinational companies found that 72 per cent of published sustainability reports mentioned the SDGs, but just 23 per cent included meaningful key performance indicators (KPIs) and targets.1 Without numbers, sustainability reporting quickly becomes a public relations exercise. Third, reporting needs to be comparable. Companies can choose from a variety of different sustainability frameworks, which results in different information being disclosed. These inconsistencies create challenges (and costs) for investors and other stakeholders in interpreting and comparing data. Investors can easily end up with tens of different KPIs measuring the same topic, which makes comparing companies challenging.

Prime the sustainability pump

The United Nations Secretary-General has convened the Global Investors for Sustainable Development (GISD) Alliance, a group of 30 global business leaders, to help develop a shared understanding on what sustainable investing means, and how to measure its impact. Once developed, investors will be able to align their investment with the definition and develop investment products in line with it. To implement such a definition, investors would benefit from the many initiatives underway to create principles and guidance to reinforce investment practices as well as technical criteria defining what is “sustainable”, such as the EU taxonomy for sustainable activities. This shared understanding about sustainable development investing can create a strong signal to the market. But it can only succeed if accompanied by coherent policy and regulatory frameworks. These frameworks must not only enable a proper assessment of corporate contribution to the SDGs, but also penalize unsustainable practices and discourage short-term thinking in capital markets. In the Financing for Sustainable Development Report 2020,2 more than 60 international agencies from the United Nations system and beyond, including the International Monetary Fund and the World Bank, have put forward concrete recommendations for action by governments to make this transformation a reality, such as adopting global mandatory disclosures on climate-related financial risk like those promoted by the Task Force on Climate-related Financial Disclosures (TCFD). The COVID-19 stimulus packages and bailout programmes provide a unique opportunity to further advance the private sector alignment with the SDGs. For instance, companies receiving financial assistance could be asked to commit to stricter reporting requirements on socioeconomic issues, as well as carbon reduction targets. This is the kind of approach pioneered by Canada. Governments and investors have a shared interest. They need to work together to bring the world on a sustainable path that can create long-term wealth. The United Nations is committed to help build a bridge between the two and engage both governments and the private sector to transform the way business and finance work. A transformation towards more sustainability involves raising the bar for sustainable investment to counter the risk of greenwashing and enhancing corporate disclosure to enable SDG-aligned investments.

Welcome to the United Nations

Welcome to the United Nations