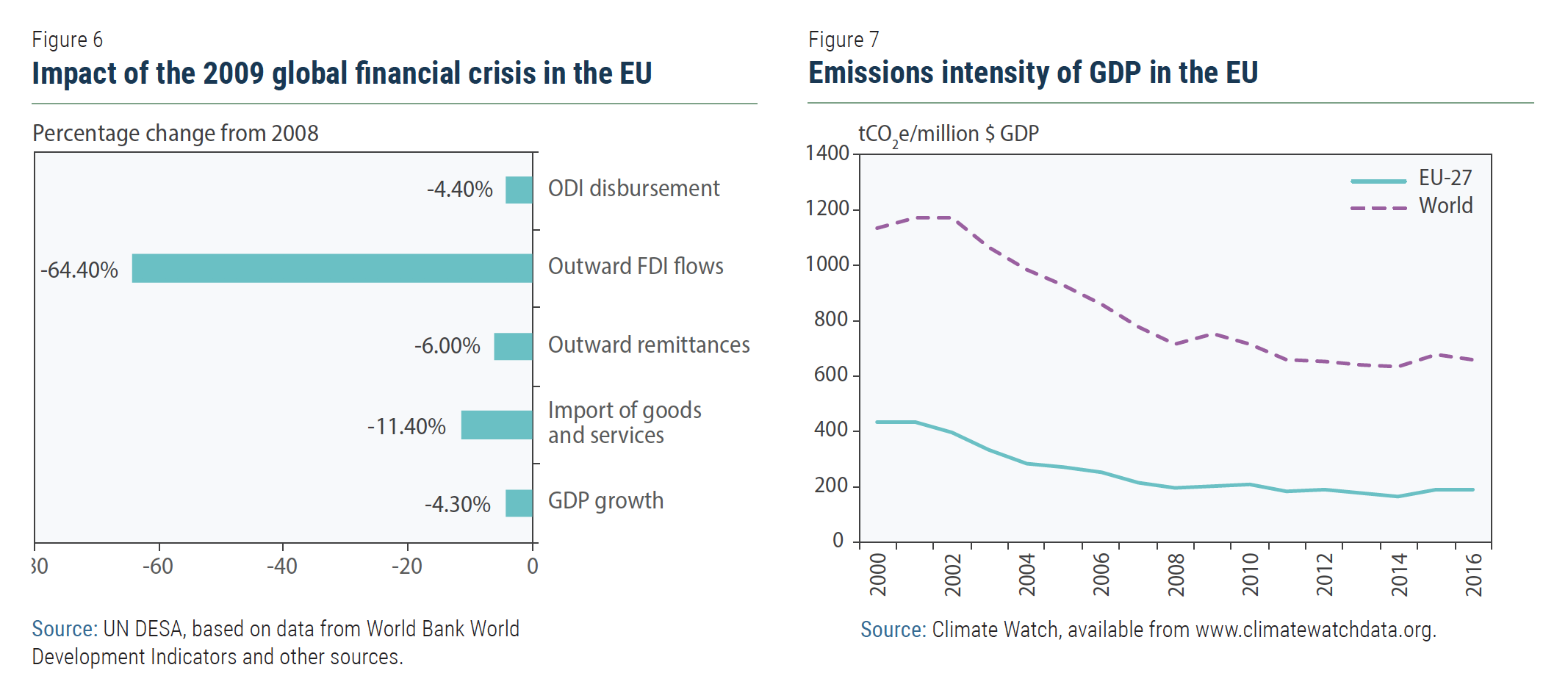

Europe faced the brunt of the COVID-19 pandemic in March, with its share of total deaths rising from about 1% of the global total to 72% in just one month. The region’s share of global COVID-19 related deaths fell to 68% by 9 April (Figure 1), as death tolls sharply increased in the United States. In Italy and Spain—the two hardest hit countries in Europe—the daily death tolls are falling. In many other countries, the daily number of deaths has been declining or has plateaued.

Europe faced the brunt of the COVID-19 pandemic in March, with its share of total deaths rising from about 1% of the global total to 72% in just one month. The region’s share of global COVID-19 related deaths fell to 68% by 9 April (Figure 1), as death tolls sharply increased in the United States. In Italy and Spain—the two hardest hit countries in Europe—the daily death tolls are falling. In many other countries, the daily number of deaths has been declining or has plateaued.

Flattening the curve versus flattening the economy

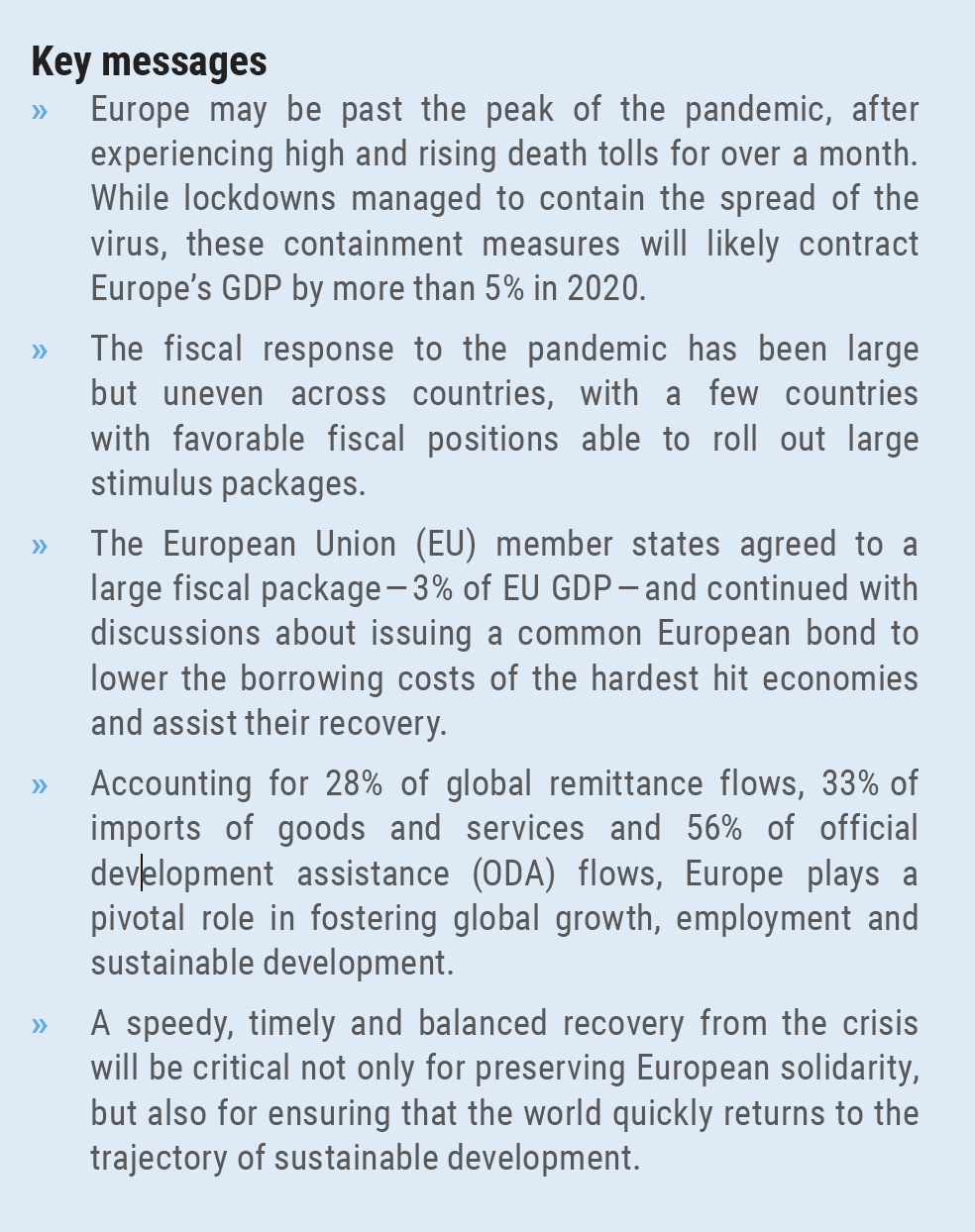

With a rapidly rising number of confirmed cases, European governments faced a difficult choice between flattening the curve versus flattening the economy. Italy, confronting a raging outbreak, enforced a nationwide lockdown on 9 March. By the third week of March, the number of countries with nationwide lockdowns rose to 17 (Figure 2). As efforts to contain the spread of the virus and flatten the curve continue, over 80% of the European population is now under lockdown.

Lockdowns and wide-ranging restrictions on economic activities are exacting heavy tolls on the European economies. GDP is expected to shrink by more than 5% across the region in 2020, depending on the duration and intensity of lockdowns and offsetting effects of various fiscal measures. By some estimates, the German economy—the largest in Europe and the fourth-largest in the world—is projected to shrink by 5% in 2020. Similar or larger contractions are expected for France, the United Kingdom, Italy and Spain. During the Great Recession in 2009, the EU-28 economies shrank by 4.3%.

Growing economic tolls are putting pressure on governments to reopen their economies. Despite high economic costs, Italy and the United Kingdom have extended their lockdowns until the beginning of May. On the other hand, Austria, Czech Republic and Denmark have started the process of slowly reopening their economies. It is likely that restrictions on movements and gatherings will persist in most countries in the near future, which will continue to impact economic activities related to sports and entertainment.

Growing economic tolls are putting pressure on governments to reopen their economies. Despite high economic costs, Italy and the United Kingdom have extended their lockdowns until the beginning of May. On the other hand, Austria, Czech Republic and Denmark have started the process of slowly reopening their economies. It is likely that restrictions on movements and gatherings will persist in most countries in the near future, which will continue to impact economic activities related to sports and entertainment.

Some countries performing better than others

European economies are more homogenous than most other economies in other regions. The dispersions in per capita income within and across countries are lower in Europe than in other continents. Yet, the region is witnessing a significant disparity in COVID-19 related outcomes—particularly in case fatality rates—across countries. Fatality rates in Italy or the United Kingdom exceeded 13% of confirmed cases, while rates in Germany or Austria remain around 4% (Figure 3).

Factors such as early testing and tracing, the age and health conditions of the infected, and the capacity of the health system to cope with the disease largely explain the cross-country differences. Aggressive testing, for example, helps identify milder cases, resulting in a more accurate count of how many people have the virus and of the actual fatality rate. On the other hand, the probability of death from Covid-19 rises with age and pre-existing health conditions. An 80-year-old is more than 30 times likely to die if infected by the virus compared to someone aged 40–49 years. While the populations of Italy and Germany have similar age structures, in Italy the median age of those infected is 62 years, but the cases in Germany have a median age of 49 years. Fatality ratios are also likely associated with the capacity of health systems, particularly intensive care units, to cope with the influx of patients and provide a high standard of care. Unlike in Italy, the German health care system—with the most intensive care beds per capita in Europe—has not been overwhelmed with a surge of cases.

Factors such as early testing and tracing, the age and health conditions of the infected, and the capacity of the health system to cope with the disease largely explain the cross-country differences. Aggressive testing, for example, helps identify milder cases, resulting in a more accurate count of how many people have the virus and of the actual fatality rate. On the other hand, the probability of death from Covid-19 rises with age and pre-existing health conditions. An 80-year-old is more than 30 times likely to die if infected by the virus compared to someone aged 40–49 years. While the populations of Italy and Germany have similar age structures, in Italy the median age of those infected is 62 years, but the cases in Germany have a median age of 49 years. Fatality ratios are also likely associated with the capacity of health systems, particularly intensive care units, to cope with the influx of patients and provide a high standard of care. Unlike in Italy, the German health care system—with the most intensive care beds per capita in Europe—has not been overwhelmed with a surge of cases.

Governments rolling out large and uneven fiscal stimulus

Governments rolling out large and uneven fiscal stimulus

Economic responses to the pandemic also vary across the region. The fiscal expansions in Germany, France, United Kingdom, Italy and Spain will remain critical for averting the economic fallout of the crisis, as they account for nearly 75% of the European economy.

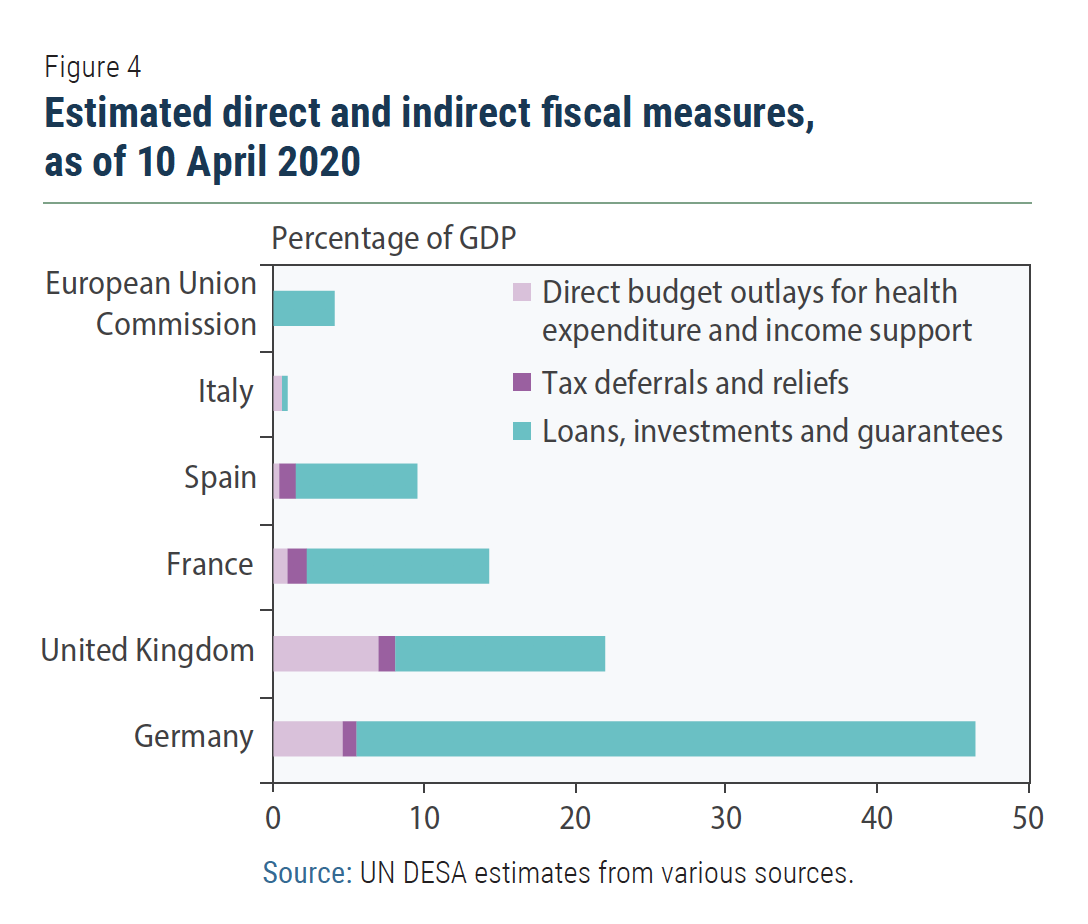

Most governments have introduced broad-based fiscal stimulus, comprising: (a) budgetary outlays for additional health expenditure and cash transfers to households and businesses to support income and employment; (b) tax breaks, deferrals and tax reliefs; and, (c) loans, loan guarantees and investments in businesses (Figure 4).

The United Kingdom, for example, announced that it would pay up to 80% of wages for workers who are at risk of being laid off due to the pandemic. France will spend 11 billion euros—about 0.5% of GDP—to support a short-time work program. Firms will be allowed to defer their payments of social and fiscal charges and there will be tax relief for the most distressed companies, amounting to an estimated 32.5 billion euros or 1.3% of GDP.

The German Government has announced 153.9 billion euros —4.5% of GDP to support, among others, a short-time work scheme to prevent layoffs, social assistance for self-employed, and additional health insurance and long-term care. In addition, the German government has announced measures in the amount of more than 1.4 trillion euros or 41% of GDP to strengthen the loan guarantee framework for businesses. In contrast, Italy has announced 4.7 billion euros—0.3% of GDP—in loans for businesses, especially for SMEs.

Countries with a more favorable fiscal position are able to undertake larger fiscal stimulus to minimize the economic impacts of the pandemic. Germany, for example, entered the crisis with a fiscal surplus and a relatively low level of government debt. The virtue of maintaining fiscal surplus—which allows a country to tap into fiscal surpluses during rainy days—may encourage many countries in the region to pursue primary surplus, prematurely roll back fiscal stimuli and pursue fiscal consolidation. But the countries most affected by the pandemic will need to pursue expansionary fiscal policies in the foreseeable future to fight the economic fallout of the pandemic.

Countries with a more favorable fiscal position are able to undertake larger fiscal stimulus to minimize the economic impacts of the pandemic. Germany, for example, entered the crisis with a fiscal surplus and a relatively low level of government debt. The virtue of maintaining fiscal surplus—which allows a country to tap into fiscal surpluses during rainy days—may encourage many countries in the region to pursue primary surplus, prematurely roll back fiscal stimuli and pursue fiscal consolidation. But the countries most affected by the pandemic will need to pursue expansionary fiscal policies in the foreseeable future to fight the economic fallout of the pandemic.

European solidarity facing a new test

European finance ministers agreed to a stimulus package of 540 billion euros — 3% of GDP of the EU-27 — on 9 April. The package includes 100 billion euros as a loan plan for unemployment benefits, 200 billion euros in loans for smaller businesses, and access to 240 billion euros in loans for euro area countries to draw on from the eurozone bailout fund. It was decided that the bailout funds available to countries hard hit by the crisis would be available for health-related expenditures.

The European Union Commission has allowed greater fiscal flexibility by triggering the escape clause in the Stability and Growth Pact (SGP). The SGP usually limits national fiscal deficits to 3% of GDP and public debt to 60% of GDP. But Italy or Spain may still not be able to take advantage of the additional SGP flexibility and undertake expansionary fiscal measures as their borrowing cost is likely to remain elevated in the near term.

The EU finance ministers did not agree on issuing a common European bond or using some other mechanism to extend financing support to countries facing the worst of the pandemic. A common European bond could help lower the borrowing costs as they face fiscal constraints. However, the issuance of common European debt has been a recurring, contentious issue as a number of member states are concerned and remain strongly opposed to the idea on the grounds that there should be no shared debt liability without shared fiscal spending authority. This would remain a challenge for European solidarity.

What a European recession means for global growth and development

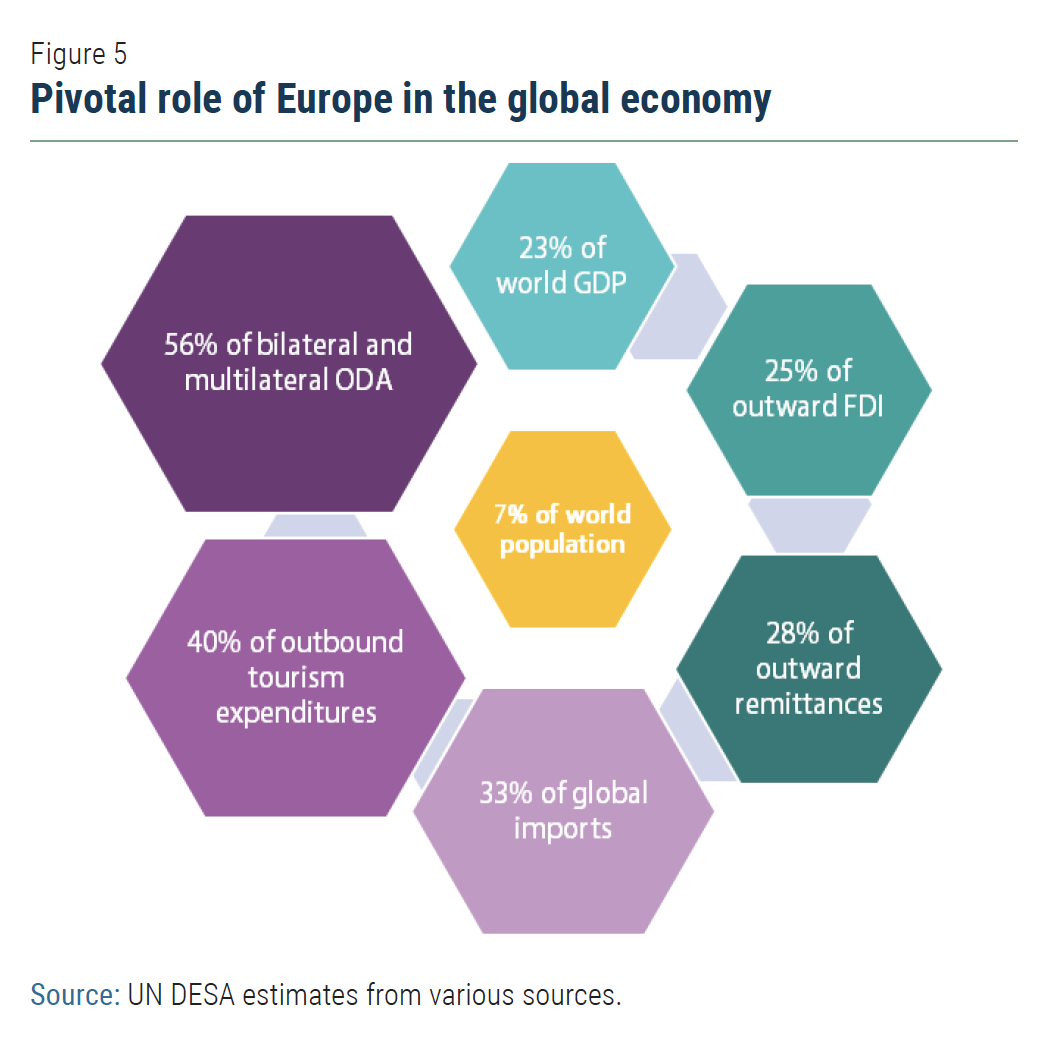

Europe—accounting for nearly one quarter of world GDP—plays a pivotal role in fostering global growth and development. Europe accounts for 33% of global imports and nearly 60% of bilateral and multilateral development assistance (Figure 5). A severe recession in Europe will reverberate to the rest of the world, undermining sustainable development efforts not only in Europe but also in Africa, Latin America and South Asia.

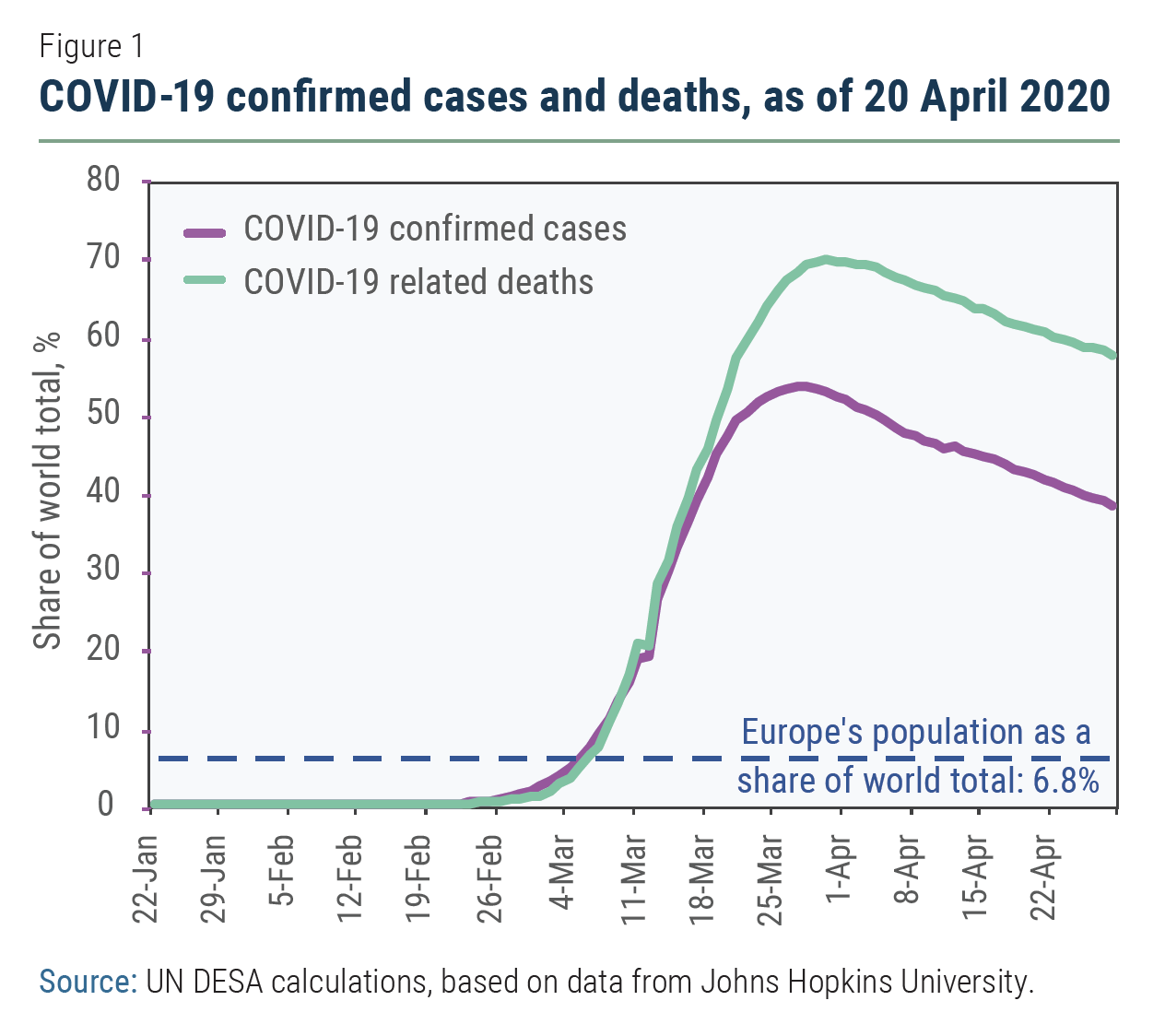

A deep recession, for example, will depress Europe’s demand for goods and services from the rest of the world, putting at risk millions of export sector jobs in developing countries that rely heavily on sending their products to the European market. During the global financial crisis in 2009, imports of the 28 EU members fell by 11%, which depressed exports and growth of many developing countries. Most importantly, outward foreign direct investment (FDI) from the EU fell by 64% during the Great Recession in 2009 (Figure 6). Global FDI flows never recovered. Global FDI today is lower than it was in 2005.

A deep recession, for example, will depress Europe’s demand for goods and services from the rest of the world, putting at risk millions of export sector jobs in developing countries that rely heavily on sending their products to the European market. During the global financial crisis in 2009, imports of the 28 EU members fell by 11%, which depressed exports and growth of many developing countries. Most importantly, outward foreign direct investment (FDI) from the EU fell by 64% during the Great Recession in 2009 (Figure 6). Global FDI flows never recovered. Global FDI today is lower than it was in 2005.

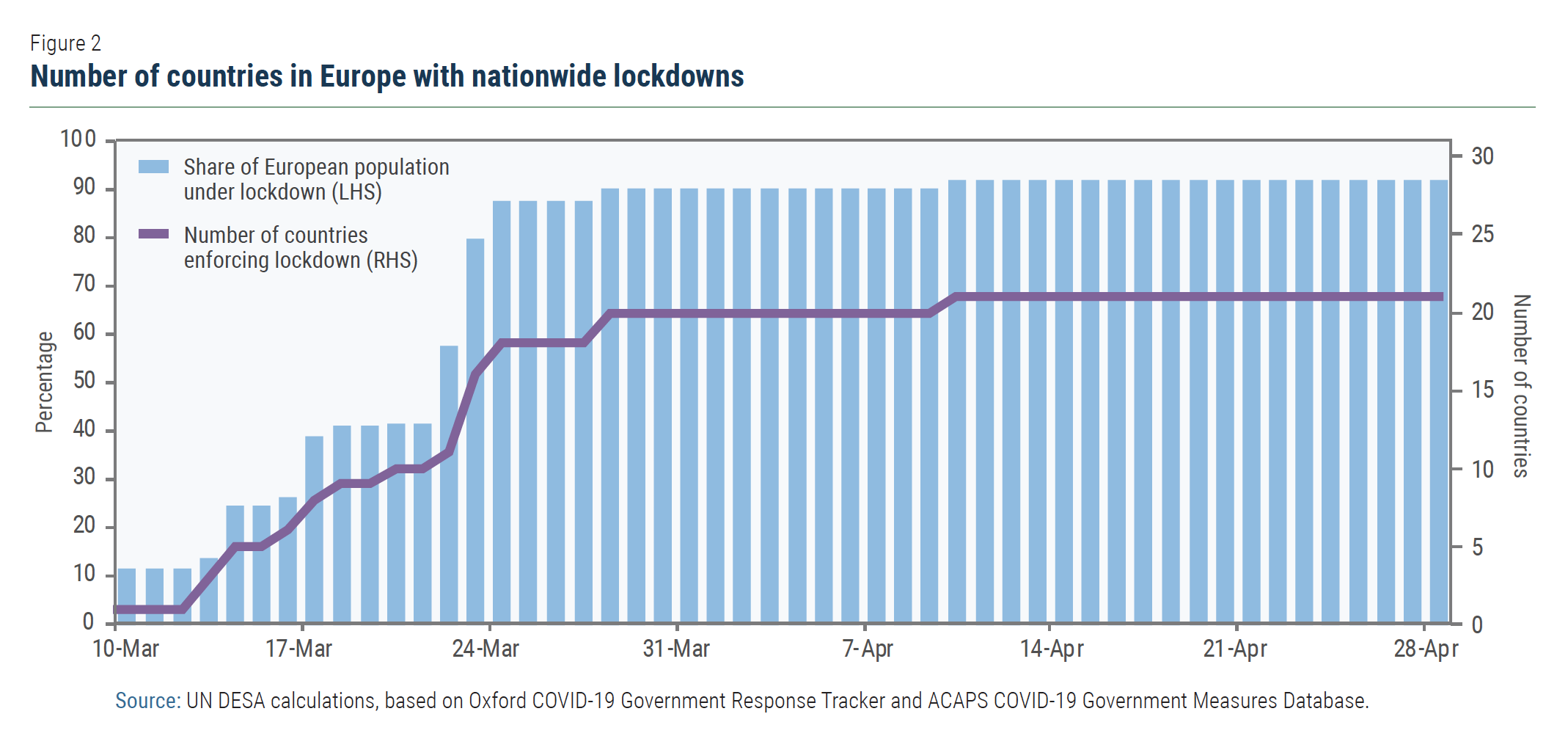

In the near term, the COVID-19-induced economic contraction may depress Europe’s efforts to promote green growth and reduce carbon footprints. While emissions intensity of GDP growth—a key indicator of transitioning to a low-carbon economy—has decreased markedly in Europe during the last decade and is far lower than global averages, it has stagnated in the past few years (Figure 7). This indicates significant financial resources would be required to further reduce emissions levels, but a deep recession may constrain the ability of many governments to offer financial incentives and fund new research for developing green technology. Low carbon prices—should it persist for an extended period—may further undermine the continent’s transition to green growth.

A speedy, timely and balanced recovery of Europe from the crisis will be critical not only for maintaining European solidarity, but also for ensuring that the continent can quickly resume its pivotal role in global trade, official development assistance, foreign direct investment and remittances and the world returns to the trajectory of sustainable development.

Welcome to the United Nations

Welcome to the United Nations