Urgent, preemptive measures needed to address twin economic and health crisis

A simultaneous health and economic crisis is hitting the developed economies hard. The sequence will likely be different for developing countries, particularly for commodity-dependent economies in Africa and Latin America. This Brief analyzes the unique challenges these countries are already facing or will face as the COVID-19 pandemic spreads.

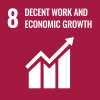

COVID-19 has paralyzed the developed economies in Europe and North America during the past month. These economies account for more than 75 per cent of confirmed cases and 83 per cent of COVID-19 related deaths worldwide (Figure 1). The panic of contagion has forced entire nations to stay indoors, rendering millions without a job. In the U.S. alone, new claims for unemployment benefits increased by more than 10 million in just two weeks.

Calm before the storm

Developing countries—especially in Africa and Latin America—are yet to see a significant increase in the spread of the virus. While these two regions account for more than 25 per cent of world population, their cumulative shares of confirmed COVID-19 cases and deaths are less than 3 per cent of global totals.

These numbers, by no means, suggest that Africa and Latin America managed to escape the worst of the pandemic. It is likely that sparse testing and reporting explain their relatively low shares of confirmed cases. There is also a strong likelihood that the pandemic wave will hit Africa and Latin America at a later stage. The effects could be devastating as millions in these countries live in shantytowns and informal settlements where social distancing of any kind will be almost impossible to enforce.

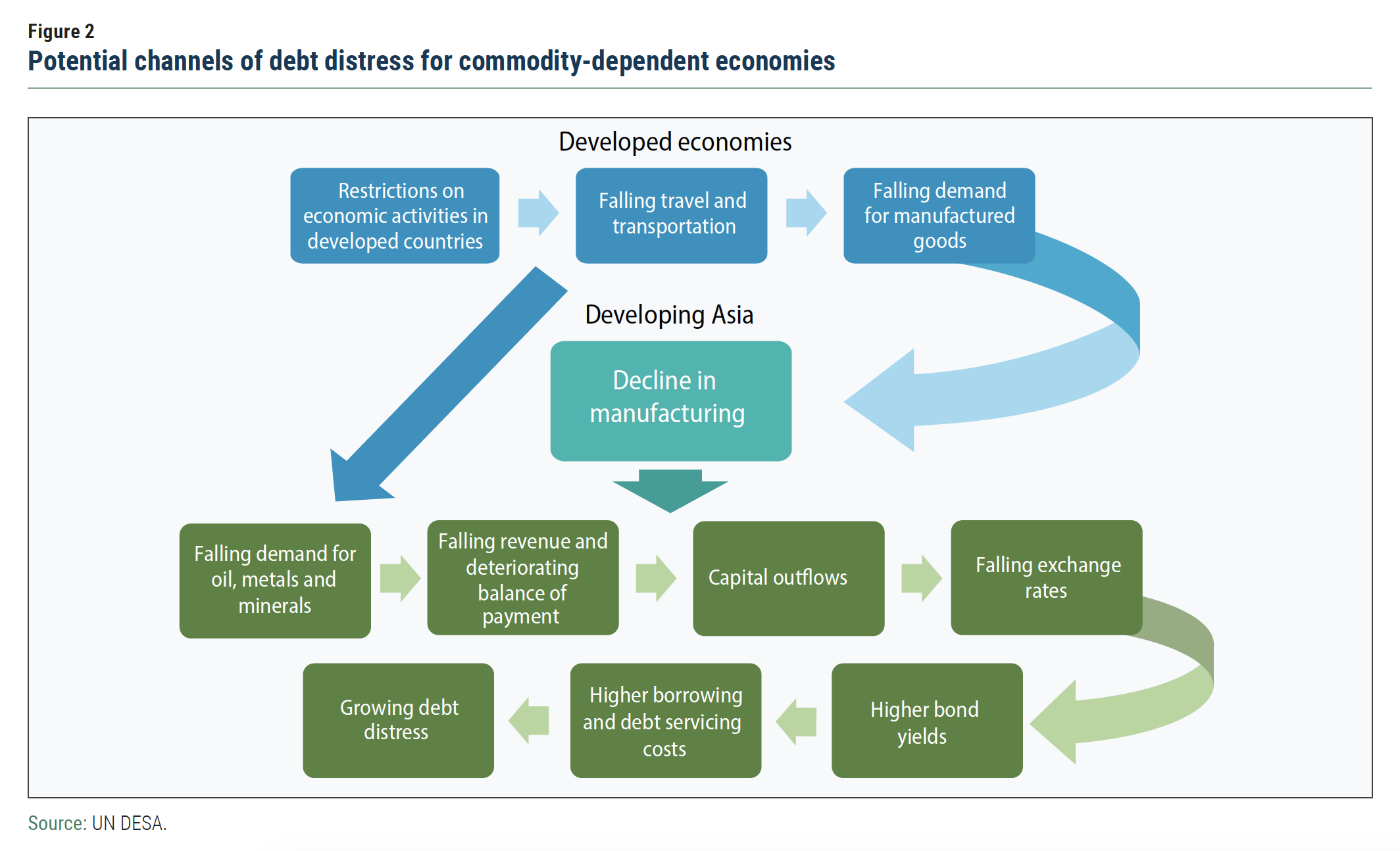

Despite a relative calm before the storm, the pandemic is already taking a heavy economic toll on the countries in Africa and Latin America, as oil and commodity prices have experienced sharp declines since the outbreak of the pandemic. Oil prices have declined by more than 50 per cent, while most metal and mineral prices declined by 20 per cent or more during the past month. This occurs as economic lockdowns and job losses in developed economies have sharply contracted travel and demand for consumer goods. Falling manufacturing activities mean less demand for base metals such as copper, iron, zinc, and aluminum.

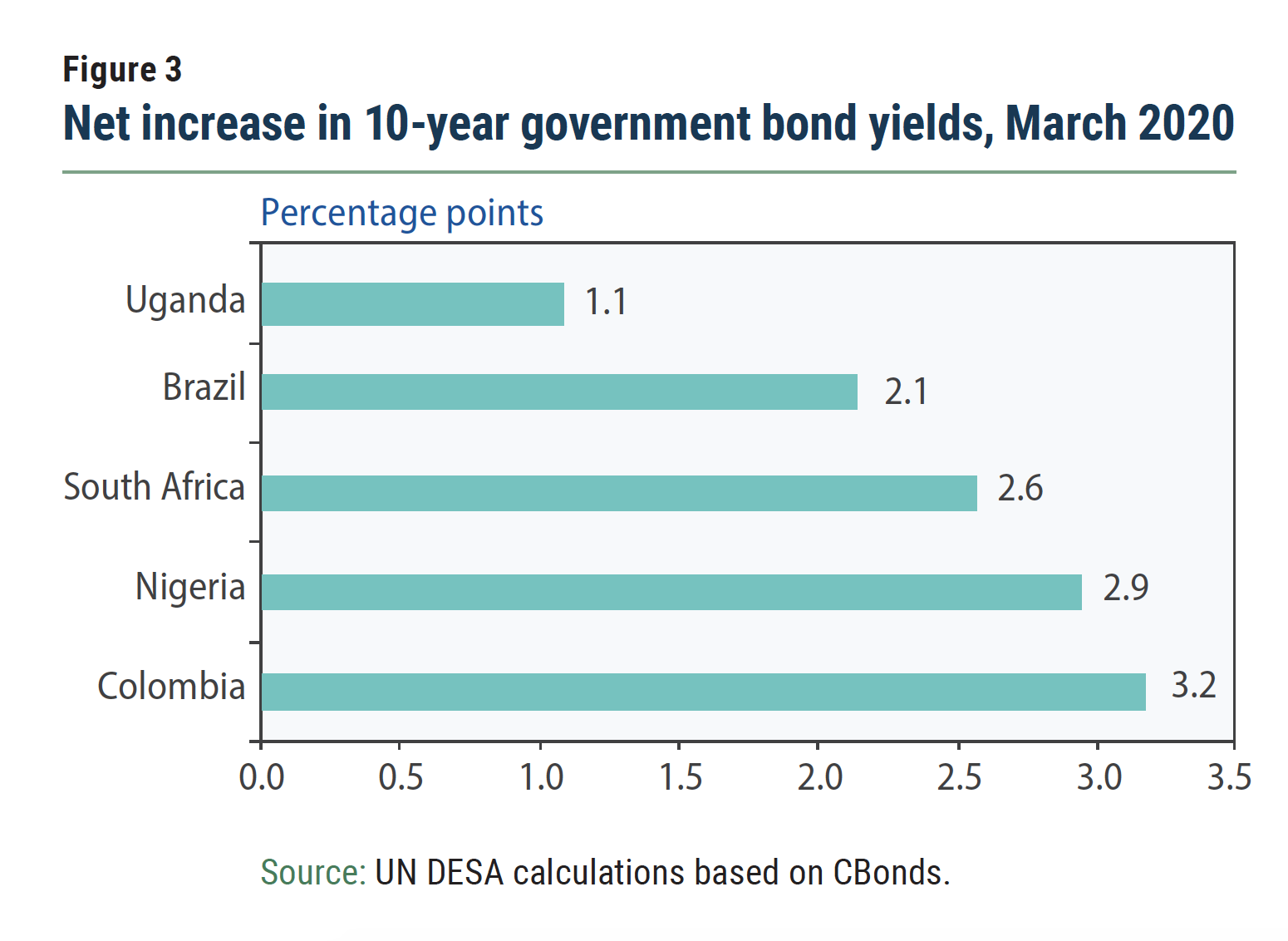

Falling commodity prices have weakened external balances, triggering a massive outflow of portfolio capital and exchange rate depreciations (Figure 2). During March 2020 alone, capital outflow from developing economies exceeded total outflow of capital during 2008. The Brazilian real, the Mexican peso and the South African rand have, for example, depreciated by about 30 per cent against the dollar since January. Capital outflows are weakening bond prices and significantly increasing bond yields. During March 2020, yields on 10-year government bonds of many commodity exporters increased by more than 2 per cent (Figure 3), making it increasingly costly for these countries to secure financing from external sources. Falling export revenues and deteriorating exchange rates are constraining the ability of these economies to service their debt and increasing levels of debt distress.

Falling commodity prices have weakened external balances, triggering a massive outflow of portfolio capital and exchange rate depreciations (Figure 2). During March 2020 alone, capital outflow from developing economies exceeded total outflow of capital during 2008. The Brazilian real, the Mexican peso and the South African rand have, for example, depreciated by about 30 per cent against the dollar since January. Capital outflows are weakening bond prices and significantly increasing bond yields. During March 2020, yields on 10-year government bonds of many commodity exporters increased by more than 2 per cent (Figure 3), making it increasingly costly for these countries to secure financing from external sources. Falling export revenues and deteriorating exchange rates are constraining the ability of these economies to service their debt and increasing levels of debt distress.

Why falling commodity prices matter

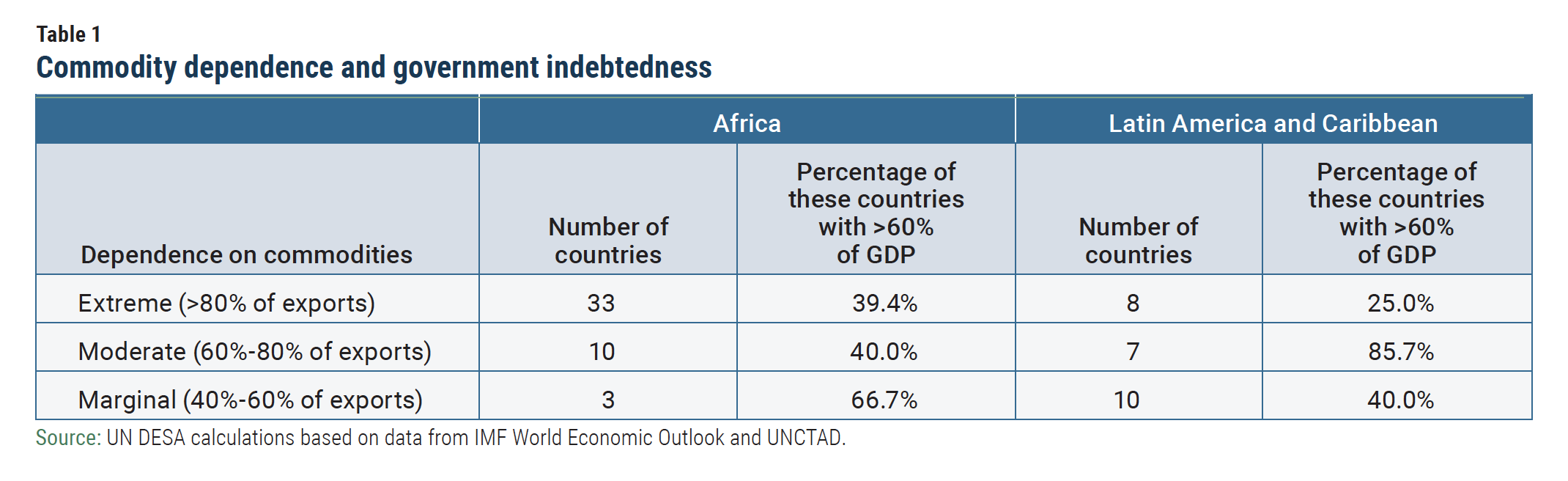

Falling commodity prices matter as many of these economies are highly dependent on commodities to finance their budgets. More than two in three countries in sub-Saharan Africa and nearly one-third of Latin American economies are extremely commodity-dependent, earning more than 80 per cent of their export revenues from commodities (Table 1).

Oil dependent economies are facing acute challenges, as oil prices are now averaging half or less than the break-even price that many of these economies need to balance their budgets. Algeria, Angola and Nigeria are still ailing from the last oil price collapse in 2014–16.

The fiscal situation: Then and now

Before the global financial crisis, prices of base metals, for example, increased by about 110 per cent between 2005 and 2008. In contrast, base metal prices increased by only 3.8 per cent during the past three years. Similarly, coal prices increased by 150 per cent during the three years before the global financial crisis. During the past three years, coal prices fell by about 20 per cent. Taking advantage of high commodity prices, most commodity exporters managed to maintain favorable fiscal balances before the global financial crisis hit their economies in 2009. In 2009, 21 out of the 25 economies in Latin America and Caribbean recorded a fiscal deficit, compared to only 10 in 2008. Similarly, 22 economies had a current account deficit in 2019, compared to 15 in 2008.

Taking advantage of high commodity prices, most commodity exporters managed to maintain favorable fiscal balances before the global financial crisis hit their economies in 2009. In 2009, 21 out of the 25 economies in Latin America and Caribbean recorded a fiscal deficit, compared to only 10 in 2008. Similarly, 22 economies had a current account deficit in 2019, compared to 15 in 2008.

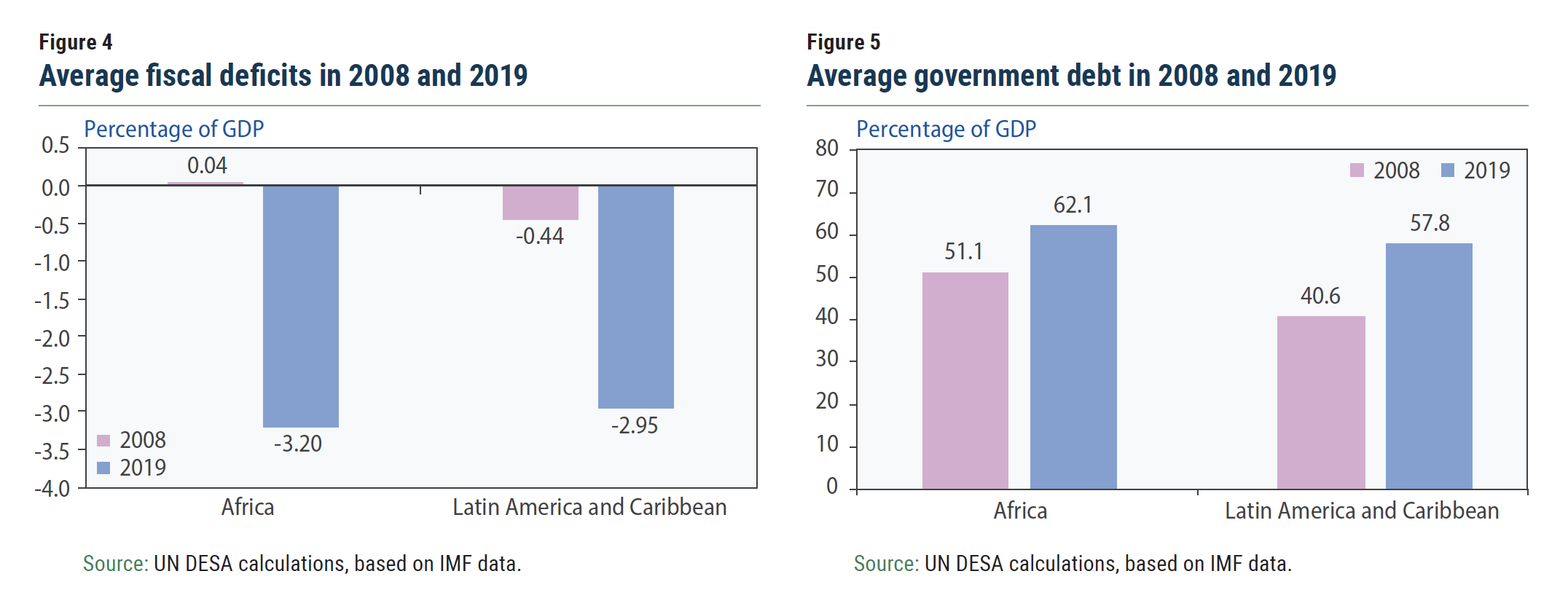

Fiscal deficits averaged less than half a per cent of GDP in Latin America while African economies maintained a fiscal surplus in 2008 (Figure 4). Given low commodity and oil prices, most countries saw their fiscal balances deteriorate during the past three years. Their international reserve positions are also generally weaker today than they were in 2008.

Between a rock and a hard place: A looming debt crisis

Many commodity exporters managed to weather the worst of the global financial crisis with favorable fiscal and current account balances. They also had relatively low levels of external debt. They may not be as lucky this time. As interest rates fell to near zero in 2008, many commodity exporters took advantage of low interest rates and significantly increased government debt during 2008–2019 (Figure 5). They are now entering a crisis with already high debt levels and significant refinancing risk, as creditors may be unwilling to roll over debt at lower interest rates, as interest rate is already very low.

It is the interaction between extreme commodity dependence (more than 80 per cent of export earnings from commodities) and high levels of government debt (more than 60 per cent of GDP) that puts these economies in a particularly vulnerable situation. In Africa, government debt exceeds 100 per cent of GDP in Djibouti, Eritrea, Mozambique, Republic of Congo and Sudan. Debt sustainability is increasingly a serious challenge for a large number of commodity exporters, as many of them may not be able to roll over their debt. Even if the pandemic is contained, it is unlikely that commodity prices will rebound very quickly amid growing stockpiles of metals and minerals. Global production and supply will continue to exceed global demand for commodities in the near term.

Fiscal response

Despite tight fiscal conditions, governments across Africa are implementing measures to contain the pandemic: rolling out emergency funds to strengthen preparedness (Zambia), targeting prevention and control of the disease including awareness campaigns (Guinea, Zimbabwe), among others. Governments also enacted measures to cushion the economic shock: general tax relief and targeted support to specific sectors (Rwanda, Senegal), payments of existing obligations to maintain cash flow for businesses (Kenya), subsidize wages for companies (Seychelles), among others.

In Latin America, governments have started to implement a wide range of support measures. However, given limited fiscal space, the stimulus packages are generally of much smaller size than in developed economies and expected to be more targeted. The measures include increased health spending, income support for vulnerable groups and emergency funds for sectors most affected by the crisis. In Brazil, the announced fiscal measures amount to a total of 3.5 per cent of GDP, but they are mostly reallocations within the 2020 budget. Chile’s Government has set up one of the largest packages in the region, at about 4 per cent of GDP, including higher healthcare expenditure, enhanced subsidies and unemployment benefits, tax deferrals and liquidity provision to SMEs.

A stitch in time saves nine

Even if the pandemic is contained, it is unlikely that commodity prices will rebound very quickly amid large and growing inventory of oil, metals and other commodities. Commodity-dependent economies need to keep this in mind, as they confront the pandemic and brace for a long and painful recovery.

More importantly, the international community should help commodity-dependent countries with high debt burdens to reduce the likelihood of a debt crisis through forbearance and standstills with debt-servicing. A stitch in time can save nine, as a full-blown debt crisis will be very costly for these economies.

Against the backdrop of increasing capital outflows and rapidly deteriorating macroeconomic conditions, multilateral sources are increasingly a critical financing source for many of these economies. Several commodity exporters, especially from Africa, have turned to multilateral organizations such as the IMF for short-term emergency assistance. International entities, including the United Nations, the IMF and the World Bank have called for debt relief initiatives. But workout of a debt-relief may take months and may be too late for many of these economies.

United Nations system entities can play a crucial role in identifying, steering and facilitating access to multilateral financing instruments, underscoring the needs for addressing both the pandemic in the short-term and augmenting financial flows for longer-term sustainable development. The short-term funding for fighting the pandemic and weathering the economic storm can very well be deployed and aligned with sustainable development priorities to ensure a better recovery from the twin crisis.

The United Nations system must work together with the international financial institutions to ensure that fighting the pandemic does not mean sacrificing sustainable development. It must ensure that commodity-dependent economies use the short window—and their scarce financial resources—to achieve both.

Welcome to the United Nations

Welcome to the United Nations