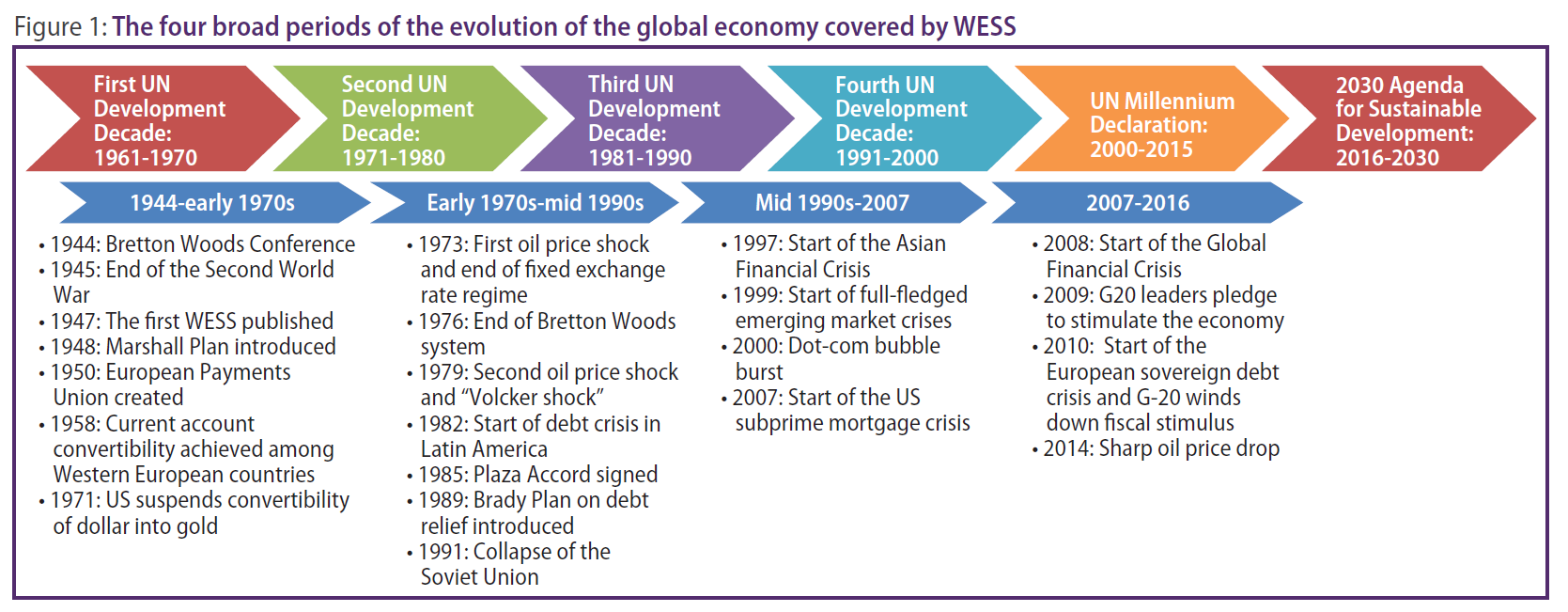

In drawing the most relevant lessons for implementing the 2030 Agenda for Sustainable Development, the World Economic and Social Survey 2017 systematically reviews the seven decades of development discussions contained in the publication – the oldest continuous publication of its kind. Since its inception in 1947 and before the publication of the World Bank’s first World Development Report in 1978, the Survey had been the only publication that produced annual reporting and analyses of the global economic trends and their development implications. As such, the Survey has documented a wealth of development experiences across the different phases of global economic development (see Figure 1). While each phase has its own specific characteristics, the review of the Survey shows that there are some commonalities among the development challenges that the world faced at different periods of time. In fact, the international community is confronting similar challenges for the implementation of the 2030 Agenda for Sustainable Development.

This brief highlights the key findings contained in WESS 2017. This policy brief discusses the relevance and key messages of the Survey in view of the current global development situation.

Relevance of the Survey for sustainable development

As the world is entering the critical early stage of implementing the 2030 Agenda for Sustainable Development, a key objective of the World Economic and Social Survey 2017 is to reflect on previous development lessons that are relevant for the pursuit of sustainable development. Through the lens of the understanding that development is structural transformation driven by national policy and global development environment, the Survey’s long history of development analyses are closely in line with the emphasis of the 2030 Agenda on growth, industrialization, and infrastructure, and the integration of all three dimensions of sustainable development. The 2030 Agenda recognizes that the transition towards sustainability will require fundamental structural and institutional changes to strengthen the links among economic growth, human development, and the environment. Moreover, within the economic dimension, the 2030 Agenda affirms that deep structural transformation is needed to diversify the economy and strengthen productivity growth in ways that would create decent jobs and improve living standard. However, the current global economic situation is challenging for achieving the sustainable development agenda. The world continues to struggle against a prolonged economic slowdown that is characterized by weak labor markets, low levels of investment, tepid international trade activities, and poor productivity growth. The decelerated progress in some of the Millennium Development Goals (MDGs) during the final – and post-crisis – years of the MDG period highlights the importance of sustained and inclusive economic growth, full and productive employment, and macroeconomic and financial stability to the achievement of the Sustainable Development Goals (SDGs). On the policy side, given the currently very low interest rate environment, both conventional and unconventional monetary policy instruments appear to have limited effects in bringing economies back to full strength. As demonstrated by past experience, a more balanced use of monetary and fiscal policy instruments is needed to support faster inclusive growth. The current weak global growth is likely to affect the achievement of SDGs in multiple ways. Slow growth limits job creation and income growth, which in turn affects efforts to eliminate poverty. It also constrains financial resources for investments in crucial areas such as infrastructure, healthcare, education, social protection, and climate change mitigation and adaptation. Furthermore, insufficient resources could undermine the political will to pursue the 2030 Agenda. In light of the current global economic environment and its implication for sustainable development, development lessons distilled by the Survey over the previous global economic cycles could be particularly relevant.

Key messages from the Survey

With no particular order, the following are the six key messages that were concluded from a careful review of the 70 years of the WESS publication and are most relevant for the implementation of the 2030 Agenda: (1) development is multidimensional, context-specific, and about transformation; (2) development planning and State capacity are important to achieve results; (3) global integration requires global policy coordination; (4) stability in the international monetary and trade system underpins development; (5) countries need adequate policy space to accelerate development; and (6) international solidarity plays an important role supporting national development efforts.

Development is multidimensional, context-specific, and about transformation

While the concept of development has evolved over time, the Survey recognizes that “the problem of economic development is not merely one of inducing marginal shifts in the allocations of resources among existing branches of economic activities; it is rather one of introducing large-scale fundamental changes into the economic structure…” (WES 1959, p.7). Also, development is a multidimensional concept and there are strong inter-linkages among economic, social and environmental objectives. High and stable growth is central to development, but a rapid breakup of the traditional sector in pursuit of growth is not recommended. In fact, an optimal growth path requires a balance between the release of factors from the subsistence sector and the opening up of employment opportunities in the market sector. In any case, the specific development approach adopted by countries has to reflect the culture and preferences of its people as well as the resources and technology available to it, as there is no one predestined development path that all countries must follow.

Development planning and State capacity are important to achieve results

Strengthening States’ capacity for strategic planning is crucial for sustainable development, as the latter requires proper coordination across various policy areas and diverse actors, including the private sector, governments, and civil society. Moreover, strategic planning ensures that development policy decisions are not made only in response to the circumstance of the moment but also contribute actively to bringing about the structural and institutional changes that underpin development. The importance of strategic planning comes with the recognition that the State plays a critical role in development. The contrast between the experiences of Latin American and the Caribbean and African countries relative to Asian countries in the 1980s and 1990s provided insights into the importance of a more active developmental State. As the latter showed stronger progress in growth, economic diversification and poverty reduction, the former set of countries endured large development setbacks. While these setbacks could be attributed to debt mismanagement and sudden change in international financing conditions, they were also a result of the countries’ subsequent adherence to a narrow, prescriptive market-centered development model – a doctrinaire embodiment of the Washington Consensus. Given their critical role in development, national States have to strengthen their overall capacity, including in public administration for domestic resource mobilization and provision of quality social services.

Global integration requires global policy coordination

Since its inception, the WESS has long recognized the need for coordinated global action to accelerate the growth of world production, to facilitate the flow of goods and services across countries and to support effective utilization of resources within each country in the context of an “expanding and integrated world economy” and in the interest of promoting “higher standards of living, full employment and conditions of economic and social progress and development” (p. 29) in line with Article 55 of the Charter of the United Nations. Multiple junctures in the past seven decades of the evolution of global economy illustrated the grave consequences of ineffective international cooperation. In particular, since the 1990s, intensification of global economic integration has clearly outpaced the development of global institutions and arrangements for proper governance of the global economic system. While it has had devastating and long-lasting impact on the global economy, the outbreak of the Global Financial Crisis in 2008 was only the most recent in a long list of economic events that exposed the inadequacy of international mechanism in coordinating macroeconomic policy and refining the global financial architecture in adapting to the ever-changing economic landscape.

Stability in the international monetary and trade system underpins development

Stable international monetary and trade systems play a foundational role in global efforts to achieve sustainable development. A recurrent concern of the Survey is the volatile commodity prices. The absence of mechanisms to manage such prices swings and corresponding fluctuations in foreign exchange earnings has continued to be a feature of the world economy since the early post-war period. Given excessive volatility in the commodity markets significantly disrupts development, the Survey has put forward proposals to manage commodity price fluctuations, which include an international commodity price stabilization fund that helps low-income countries in coping with price fluctuations. In ensuring international trade stability, the Survey has also consistently warned about the dangers of trade protectionism. Such protective trade stance could result in a slowdown in productivity growth, technology diffusion, and broader economic growth. Regarding the international monetary system, the Survey points out that the current framework – which emerged after the collapse of the Bretton Woods system in the 1970s – has proven volatile and crisis-prone. In particular, the system is overly relying on the US dollar as the reserve currency and has no mechanism to orderly address global imbalances. In light of these problematic features, the Survey has advocated for a shift away from a single-currency global financial system and toward stronger reliance on common reserve pools. It also repeatedly calls for effective financial regulation and supervision to prevent speculation and financial bubbles. Addressing these challenges over time would require political leadership, a shared vision of development, and joint commitment to balance the responsibility of adjustment among countries according to respective development levels.

Countries need adequate policy space to accelerate development

During times of crisis and major adjustment, flexibility that gives countries more space in adopting nationally appropriate policies is of great importance in facilitating economic recovery and development. One example that signified the importance of policy flexibility could be found in early 1950s, when the International Monetary Fund (IMF) granted the European Member States additional time for gradually eliminating foreign exchange restrictions and implementing current account convertibility – an obligation under the Articles of Agreement of the IMF. It was precisely this type of flexibility that helped many of the Western Europe countries in eventually removing foreign exchange controls and achieving current account convertibility – two developments that were crucial in facilitating stronger international trade activities. In sharp contrast, the rigid international response to the debt crises in the 1980s – including the imposition of fiscal austerity on debtor countries as part of the strict conditionality of debt restructuring – led to a lost development decade for many countries in Latin America and the Caribbean and Africa. Similar concerns about the need to provide countries with the policy space to mitigate their economic imbalances were also raised in the more recent episodes of debt crises in Greece and other highly indebted countries. In light of these events, the Survey has argued for fair sharing of the adjustment burden among deficit and surplus countries. It has also called for due attention to the social costs of sharp deficit reduction.

International solidarity plays an important role supporting national development efforts

International solidarity has played an important role in development and reconstruction. For example, the European Reconstruction Program of the United States, better known as the Marshall Plan, together with the aforementioned flexibility in the enforcement of international commitments helped countries to rebuild their economies after the Second World War. This combination of factors also facilitated the recovery of financial stability, the achievement of more efficient resource allocation, and the acceleration of trade liberalization – all of which supported a long period of post-war economic prosperity. Official Development Assistance (ODA) has also played an important role in supporting development efforts of developing countries. In addition, it has also facilitated the integration of countries into the global economy. However, it should be noted that the long-standing target of developed countries to provide ODA equivalent to 0.7 per cent of their gross national income to developing countries has only be achieved by a handful of countries so far. Furthermore, the Survey has expressed specific concerns about the lack of additionality of financial flows for climate change mitigation and adaptation, drawing attention to the issue that contributions for climate change may be diverting resources away from traditional development projects.

Welcome to the United Nations

Welcome to the United Nations