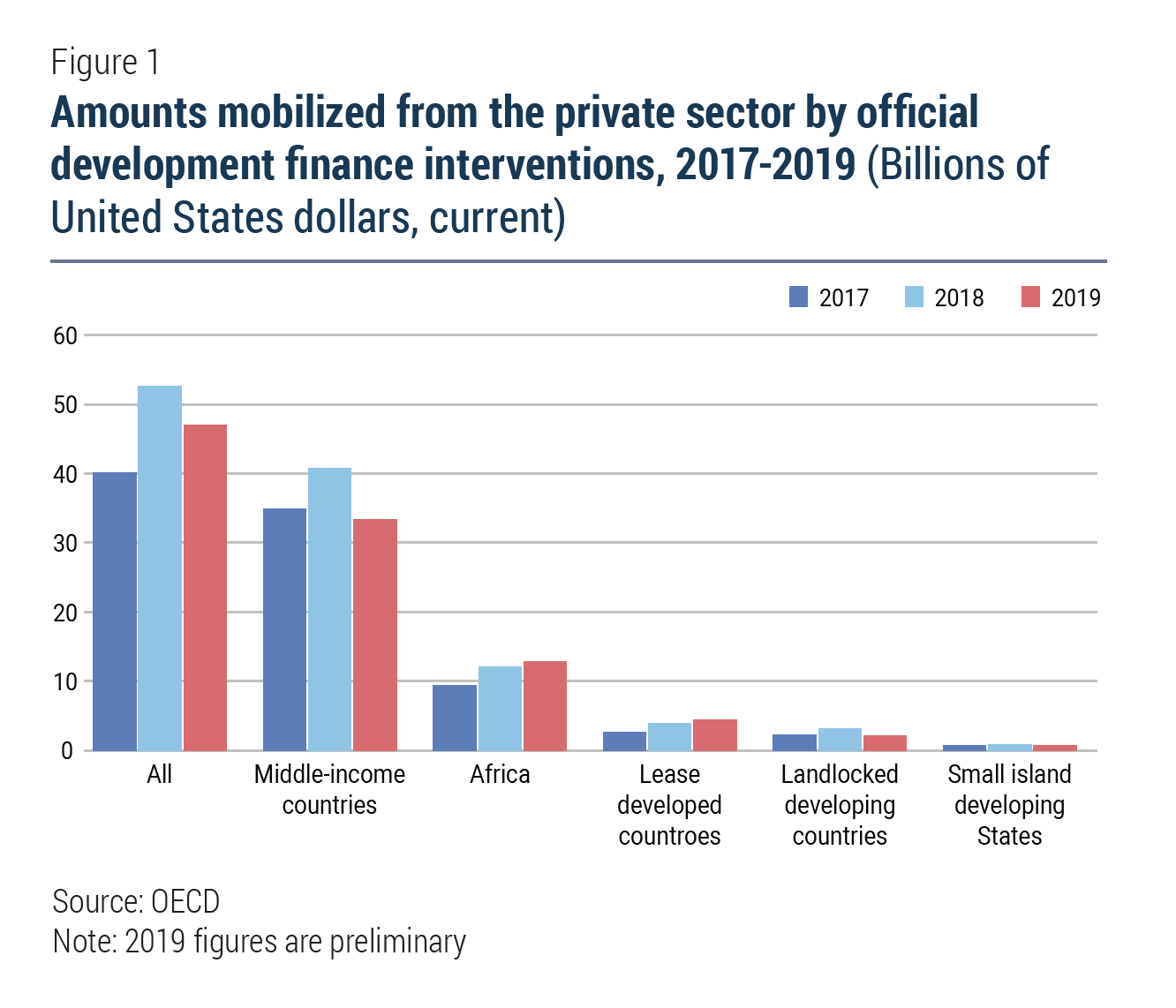

The 2015 Addis Ababa Action Agenda recognizes the role that blended finance can play, while also acknowledging that it may not be suitable for all Sustainable Development Goal (SDG) investments. Indeed, blended finance, which uses official resources to mobilize commercial financing, has been looked to as a means to incentivize greater investment in the SDGs – for many it was the means to go from “billions to trillions” in financing sustainable development. Yet, while blended finance has grown rapidly since 2015, the total amount of private finance it has mobilized is still relatively small – well below a trillion (see Figure 1). Most blended finance currently goes to middle- income countries, motivated by the size and ease of transactions. Only a small portion goes to least developed countries (LDCs) or social sectors, in part because blended finance is not appropriate for all investments or activities. In addition, concerns that blending is not an effective use of public finance, since the concessional finance that is blended will not be available for other areas, have grown in the context of the COVID crisis, given increasing demands for concessional finance. This raises questions on: how to appropriately use public resources in blended finance; what types of transactions blending is most suitable for; and how to ensure it is aligned with national sustainable development priorities.

The 2015 Addis Ababa Action Agenda recognizes the role that blended finance can play, while also acknowledging that it may not be suitable for all Sustainable Development Goal (SDG) investments. Indeed, blended finance, which uses official resources to mobilize commercial financing, has been looked to as a means to incentivize greater investment in the SDGs – for many it was the means to go from “billions to trillions” in financing sustainable development. Yet, while blended finance has grown rapidly since 2015, the total amount of private finance it has mobilized is still relatively small – well below a trillion (see Figure 1). Most blended finance currently goes to middle- income countries, motivated by the size and ease of transactions. Only a small portion goes to least developed countries (LDCs) or social sectors, in part because blended finance is not appropriate for all investments or activities. In addition, concerns that blending is not an effective use of public finance, since the concessional finance that is blended will not be available for other areas, have grown in the context of the COVID crisis, given increasing demands for concessional finance. This raises questions on: how to appropriately use public resources in blended finance; what types of transactions blending is most suitable for; and how to ensure it is aligned with national sustainable development priorities.

Blended finance main characteristics

While there is no agreed-on definition of blended finance, the main idea behind blending is to use public resources to “crowd in” commercial finance for SDG investments that would otherwise not have materialized. By shifting some of the risk or cost of a project from the private to the public sector, blended finance can enhance risk-return profiles for private creditors or investors. The objective is to unlock investment that the private sector would not have done on its own, and to do this with minimum concessionality or subsidy (i.e., just enough to make a project attractive to commercial investors). Blended finance can potentially also create demonstration effects that can incentivize commercial replication, thereby supporting the development of local financial markets. Blended finance is most relevant for investments with high sustainable development impact that are not attracting private investment, but still have a business rationale and potential cash flows to repay the private partner. This is reflected in current trends on blended finance. Around 56 per cent of blended finance deals targets the energy and banking sectors, and only around 6 per cent of deals goes to projects in social sectors, in part due to the lack of a commercially viable financial return in many social sector transactions.  Blended finance has also been geared mainly towards middle-income countries (see Figure 1). While there has been considerable focus on blended finance for LDCs and some signs of growth, only around 9 per cent of private finance mobilized went to LDCs in 2019. The low proportion of deals in LDCs reflects the fact that blended finance, like private finance, is drawn to areas with lower barriers to private capital mobilization. It can also indicate a tendency of blended finance to focus on less costly projects with lower-risk profiles, and potentially lower developmental impacts. Leverage ratios for blended finance in LDCs are also much lower than in other blended finance deals. The average private finance mobilized in LDCs is $6.1 million per deal, compared to $27 million in lower-middle-income countries and $61 million in upper-middle-income countries. It is not surprising that the leverage size is lower in LDCs. Indeed, because of the higher risk, a higher subsidy should be expected. More important than size of dollars leveraged, though, is the development impact of each public dollar spent. This includes both the measurement of the developmental impact of assets, and quantification of the cost of blending. First, on the asset side, the developmental impact of blended finance transactions is often largely unknown, due to weak monitoring, lack of standards for reporting on impact, and poor transparency – calling for strengthened transparency and reporting measures. Second, on the financing side, one of the biggest challenges in structuring blended finance deals is how to set the subsidy so that it is just high enough to attract private partners without over-subsidizing them. Blended finance deals need to be designed to minimize this risk. Third, to understand the full cost of a blended finance deal, the opportunity cost of how official sources would otherwise be used also needs to be considered. There are many competing demands for official resources, especially for concessional funds, meaning that the allocation between project choices is critical. Projects that are grounded in country ownership and aligned with national plans, and that involve local and national actors, including engagement with local communities, are much more likely to have long-lasting impacts. Yet in many blended finance transactions, such as on-lending facilities and investment funds, governments are only involved, if at all, after the investment decision is made.

Blended finance has also been geared mainly towards middle-income countries (see Figure 1). While there has been considerable focus on blended finance for LDCs and some signs of growth, only around 9 per cent of private finance mobilized went to LDCs in 2019. The low proportion of deals in LDCs reflects the fact that blended finance, like private finance, is drawn to areas with lower barriers to private capital mobilization. It can also indicate a tendency of blended finance to focus on less costly projects with lower-risk profiles, and potentially lower developmental impacts. Leverage ratios for blended finance in LDCs are also much lower than in other blended finance deals. The average private finance mobilized in LDCs is $6.1 million per deal, compared to $27 million in lower-middle-income countries and $61 million in upper-middle-income countries. It is not surprising that the leverage size is lower in LDCs. Indeed, because of the higher risk, a higher subsidy should be expected. More important than size of dollars leveraged, though, is the development impact of each public dollar spent. This includes both the measurement of the developmental impact of assets, and quantification of the cost of blending. First, on the asset side, the developmental impact of blended finance transactions is often largely unknown, due to weak monitoring, lack of standards for reporting on impact, and poor transparency – calling for strengthened transparency and reporting measures. Second, on the financing side, one of the biggest challenges in structuring blended finance deals is how to set the subsidy so that it is just high enough to attract private partners without over-subsidizing them. Blended finance deals need to be designed to minimize this risk. Third, to understand the full cost of a blended finance deal, the opportunity cost of how official sources would otherwise be used also needs to be considered. There are many competing demands for official resources, especially for concessional funds, meaning that the allocation between project choices is critical. Projects that are grounded in country ownership and aligned with national plans, and that involve local and national actors, including engagement with local communities, are much more likely to have long-lasting impacts. Yet in many blended finance transactions, such as on-lending facilities and investment funds, governments are only involved, if at all, after the investment decision is made.

A new approach to blended finance

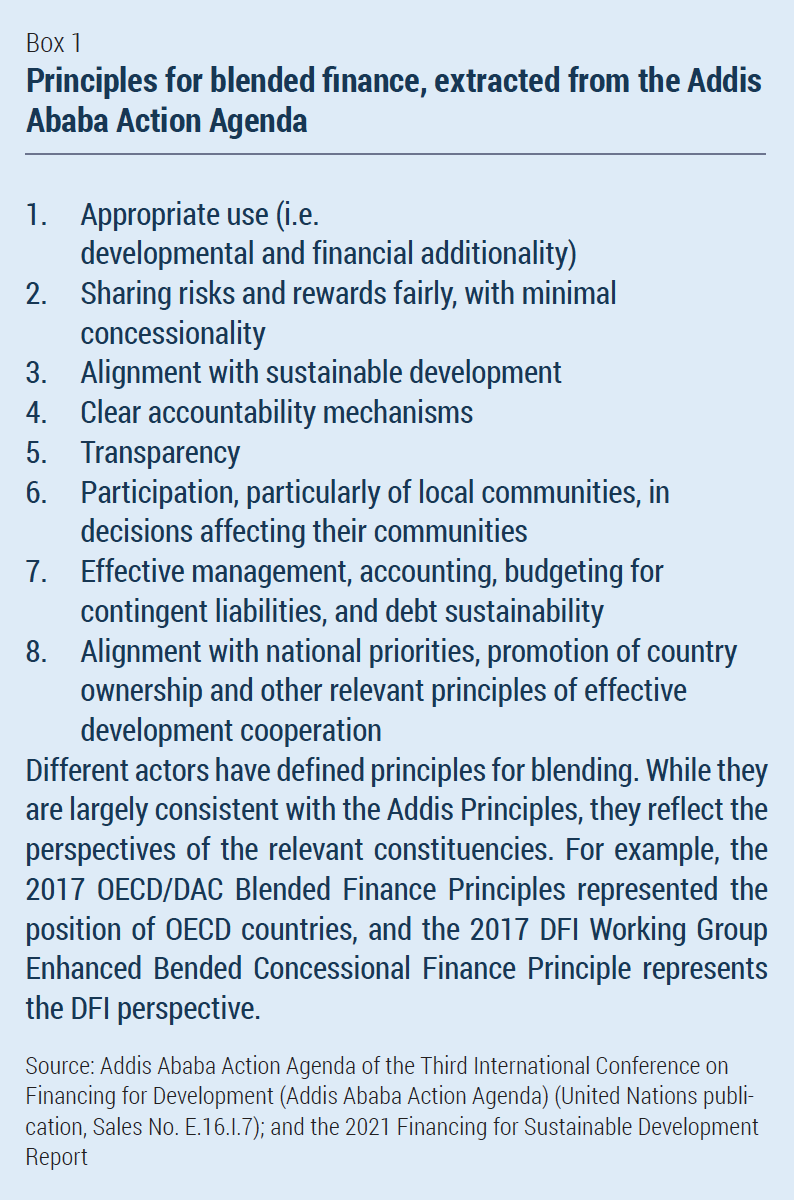

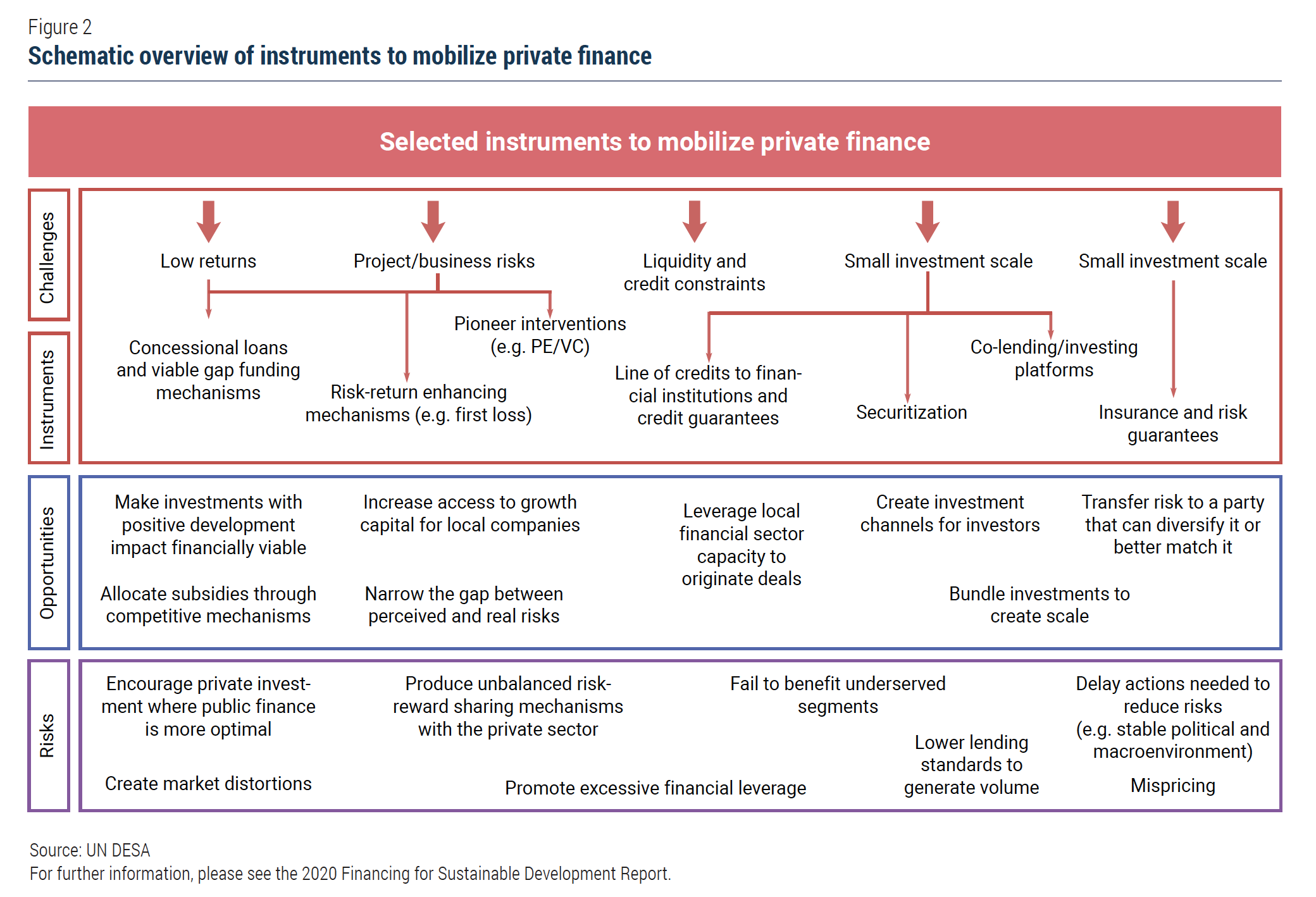

A new approach is needed to scale up blended finance and increase its impact. This approach highlights six elements that need to be considered in determining the appropriate usage of blended finance. Most of these are based on agreed upon principles of blended finance, but they are not yet systematically incorporated into blended finance transactions (see Box 1 for the Addis Principles on blended finance).  First, deals should be driven by country ownership and country needs. Many countries have private sector development strategies in place, or related strategies to develop productive capacities and sustainable industrialization. Providers of blended finance should work with governments to align their efforts with these national priorities. A country-led blended finance analysis, within an Integrated National Financing Framework (INFF), could guide development partners on where and how to use blended finance in a country, and help align projects with national plans in a flexible manner. This would ensure coherence between the existing gamut of blended finance priorities, defined by donors and MDBs using different parameters and resulting in at times diverging priorities. Second, the primary focus of all blended deals should be sustainable development impact per dollar spent (implying a shift from a focus on bankability to a focus on impact). Public resources should be allocated where the impact is the greatest and not where it is the easiest to make deals or where leverage ratios can be maximized. The latter would inevitably result in LDCs being overlooked by blended instruments. It is easier to achieve higher leverage ratios in middle-income countries—for example, by subsidizing lending of a local finance institution rather than supporting a venture capital fund in a frontier market. Similarly, concessionality levels for infrastructure projects are likely to be much higher in LDCs than elsewhere. Development partners need to acknowledge this reality and customize blended instruments to local circumstances. Development Finance Institutions (DFIs) also need to reflect this reality in staff internal objectives, so the focus is on delivering impact rather than volumes. Third, using official funds to leverage private finance should aim to use the minimal subsidy necessary to attract the private partner. This helps to ensure financial additionality – that the deal would not have happened without the public subsidy. One way to address this issue is to make grants part of a bidding process. For example, viability gap funding mechanisms have been created in infrastructure sectors to make projects financially attractive without raising user fees beyond affordability limits. In these mechanisms, the eligible private sector bidder requiring the lowest subsidy is selected. Another way to address challenges to estimating the minimal subsidy necessary ex-ante, is for providers to structure deals that allow them to share in any future upside. That way if there are profits, the public partner can get repaid in the future, without having to estimate the appropriate subsidy upfront. Financial additionality also means that concessional finance should only be used when appropriate. Instruments to leverage private finance can involve the blending of three types of financing: (i) concessional resources (e.g., ODA); (ii) non-concessional official resources (e.g., from public development banks); and (iii) commercial finance from private financiers. Although much of the discussion on blended finance has focused on using ODA to unlock private investment, it is preferable to use nonconcessional resources (such as from development banks) to leverage private investment when possible. This would allow ODA to be used directly for support of social sectors that may be less suitable for blended finance transactions. Non-concessional loans that include equitylike components (e.g., convertible debt) are particularly well suited for projects where there is a possible financial upside, such as investments in digital technologies. Fourth, analysis should always include measurement of the cost of blending versus other financing mechanisms. For example, the biggest infrastructure needs may be in social infrastructure or other areas that might not be profitable to private investors, even with enhancements. Water and sanitation—where commercial viability is often challenging due to equity concerns—has attracted a limited amount of private finance mobilized by official development finance (2.4 per cent of the total OECD-reported amounts mobilized from the private sector), while social sectors, such as health, education and gender equality, are scarcely covered. In those cases, public investments might be more appropriate, even if a complex blended deal could be arranged. Indeed, these are the types of cases where blended deals could fail or cause a public backlash when the size of the subsidy to the private partner becomes public. Fifth, analysis should include the cost and benefit of complementary investments and alternative policies in decision-making on how to prioritize blended finance. For example, in some cases it makes more sense to use concessional funds to first strengthen the enabling environment, rather than financing specific deals. Strengthening the investment environment reduces risks for investors, thus lowering the cost of finance (as opposed to blending, which shares risks between the public and private parties). However, in other cases, the blended finance investment can help strengthen the enabling environment (e.g., resilient infrastructure), and could be an efficient way to develop the local markets. Sixth, capacity development support, including helping countries identify and apply appropriate instruments will, in many instances, be crucial for success. In addition, reporting on impact and transparency are critical both to decision-making and to monitoring and review. Consultations with stakeholders are also means of enhancing transparency in general and driving effective development cooperation. Governments and engaged partners should work towards ensuring that blended finance facilities enhance the quality of monitoring, evaluation and, ultimately, sustainable development impact. There are some important efforts to address these issues. For example, the International Finance Corporation (IFC) began to publicly release the estimated subsidy of every blended concessional finance transaction as a percent of total project cost or project value for projects mandated after October 2019. The new approach to blended finance should also be based on understanding the underlying impediments to private investments, and using the most appropriate instrument to address these (see Figure 2). Integrated national financing frameworks (INFFs) include a binding constraint analysis—such as the country private sector diagnostics by the IFC—which can help countries identify the largest barriers to investment. For example, if the impediment to investment in a big infrastructure project is low expected returns, the solution might be concessional loans. If this is compounded by high risk (e.g., political or currency risk) the solution could include risk guarantees. If perceived risks by the private investor are out of line with the public sector’s perceptions, guarantees could be the cheapest alternative for public entities, who would be arbitraging the difference in risk perceptions.

First, deals should be driven by country ownership and country needs. Many countries have private sector development strategies in place, or related strategies to develop productive capacities and sustainable industrialization. Providers of blended finance should work with governments to align their efforts with these national priorities. A country-led blended finance analysis, within an Integrated National Financing Framework (INFF), could guide development partners on where and how to use blended finance in a country, and help align projects with national plans in a flexible manner. This would ensure coherence between the existing gamut of blended finance priorities, defined by donors and MDBs using different parameters and resulting in at times diverging priorities. Second, the primary focus of all blended deals should be sustainable development impact per dollar spent (implying a shift from a focus on bankability to a focus on impact). Public resources should be allocated where the impact is the greatest and not where it is the easiest to make deals or where leverage ratios can be maximized. The latter would inevitably result in LDCs being overlooked by blended instruments. It is easier to achieve higher leverage ratios in middle-income countries—for example, by subsidizing lending of a local finance institution rather than supporting a venture capital fund in a frontier market. Similarly, concessionality levels for infrastructure projects are likely to be much higher in LDCs than elsewhere. Development partners need to acknowledge this reality and customize blended instruments to local circumstances. Development Finance Institutions (DFIs) also need to reflect this reality in staff internal objectives, so the focus is on delivering impact rather than volumes. Third, using official funds to leverage private finance should aim to use the minimal subsidy necessary to attract the private partner. This helps to ensure financial additionality – that the deal would not have happened without the public subsidy. One way to address this issue is to make grants part of a bidding process. For example, viability gap funding mechanisms have been created in infrastructure sectors to make projects financially attractive without raising user fees beyond affordability limits. In these mechanisms, the eligible private sector bidder requiring the lowest subsidy is selected. Another way to address challenges to estimating the minimal subsidy necessary ex-ante, is for providers to structure deals that allow them to share in any future upside. That way if there are profits, the public partner can get repaid in the future, without having to estimate the appropriate subsidy upfront. Financial additionality also means that concessional finance should only be used when appropriate. Instruments to leverage private finance can involve the blending of three types of financing: (i) concessional resources (e.g., ODA); (ii) non-concessional official resources (e.g., from public development banks); and (iii) commercial finance from private financiers. Although much of the discussion on blended finance has focused on using ODA to unlock private investment, it is preferable to use nonconcessional resources (such as from development banks) to leverage private investment when possible. This would allow ODA to be used directly for support of social sectors that may be less suitable for blended finance transactions. Non-concessional loans that include equitylike components (e.g., convertible debt) are particularly well suited for projects where there is a possible financial upside, such as investments in digital technologies. Fourth, analysis should always include measurement of the cost of blending versus other financing mechanisms. For example, the biggest infrastructure needs may be in social infrastructure or other areas that might not be profitable to private investors, even with enhancements. Water and sanitation—where commercial viability is often challenging due to equity concerns—has attracted a limited amount of private finance mobilized by official development finance (2.4 per cent of the total OECD-reported amounts mobilized from the private sector), while social sectors, such as health, education and gender equality, are scarcely covered. In those cases, public investments might be more appropriate, even if a complex blended deal could be arranged. Indeed, these are the types of cases where blended deals could fail or cause a public backlash when the size of the subsidy to the private partner becomes public. Fifth, analysis should include the cost and benefit of complementary investments and alternative policies in decision-making on how to prioritize blended finance. For example, in some cases it makes more sense to use concessional funds to first strengthen the enabling environment, rather than financing specific deals. Strengthening the investment environment reduces risks for investors, thus lowering the cost of finance (as opposed to blending, which shares risks between the public and private parties). However, in other cases, the blended finance investment can help strengthen the enabling environment (e.g., resilient infrastructure), and could be an efficient way to develop the local markets. Sixth, capacity development support, including helping countries identify and apply appropriate instruments will, in many instances, be crucial for success. In addition, reporting on impact and transparency are critical both to decision-making and to monitoring and review. Consultations with stakeholders are also means of enhancing transparency in general and driving effective development cooperation. Governments and engaged partners should work towards ensuring that blended finance facilities enhance the quality of monitoring, evaluation and, ultimately, sustainable development impact. There are some important efforts to address these issues. For example, the International Finance Corporation (IFC) began to publicly release the estimated subsidy of every blended concessional finance transaction as a percent of total project cost or project value for projects mandated after October 2019. The new approach to blended finance should also be based on understanding the underlying impediments to private investments, and using the most appropriate instrument to address these (see Figure 2). Integrated national financing frameworks (INFFs) include a binding constraint analysis—such as the country private sector diagnostics by the IFC—which can help countries identify the largest barriers to investment. For example, if the impediment to investment in a big infrastructure project is low expected returns, the solution might be concessional loans. If this is compounded by high risk (e.g., political or currency risk) the solution could include risk guarantees. If perceived risks by the private investor are out of line with the public sector’s perceptions, guarantees could be the cheapest alternative for public entities, who would be arbitraging the difference in risk perceptions.

The new approach and covid-19

Scaling up blended finance may be more challenging in the COVID-19 era as blended finance deals generally favor low-risk, less-costly projects, which may prove difficult to find due to heightened financial risks from the crisis. Reorienting blended finance to focus on impact within the context of an INFF can help better position it as an option to support recovery efforts. Other options would be to pool bilateral and/or MDB official resources in a blended finance fund, which could take on more risk, as proposed in the COVID-19 Stretch Fund. However, given the high demands, ODA should be allocated to first meet the needs of the most vulnerable countries through grant finance, with blended finance facilities using non-concessional finance as a basis for leverage where possible. The blended finance community should build on enhanced collaboration practices. Since the crisis, more actors have been pursuing collaborative initiatives to mitigate risks to help incentivize greater investment in sustainable development. For example, in response to COVID-19, the DFI Alliance has been working together through risk sharing, guarantee agreements, capital arrangements, as well as sharing due diligence processes and pipelines. The DFI Working Group on Blended Concessional Finance for Private Sector Projects also provides an example of a platform for sharing experiences and best practices among DFIs. The Multilateral Investment Guarantee Agency is working to expand collaboration among partners to increase the use of political risk insurance to catalyze private investment. Building on these collaborations can help lower risks and transaction costs, as well as expedite deal flows.

Welcome to the United Nations

Welcome to the United Nations