The first weeks of May 2022 have seen a reckoning for cryptoassets (digital tokens such as Bitcoin) and so-called “stablecoins” (which aim to peg their value to a specified asset such as the US dollar). Their combined market capitalization fell from $1.85 trillion to $1.34 trillion between May 1st and May 15th, triggered by the collapse of a major stablecoin. This was down from a peak of over $3 trillion in November 2021. The drop in valuation since late 2021 was over twice as sharp as the drop in other financial market indicators, such as the S&P 500. Although there have been large swings in the valuation of cryptoassets in the past, the recent expansion of the crypto ecosystem, along with the growing participation of traditional financial institutions, has increased the financial and economic fallout of such swings and heightened financial stability risks. A growing uptake of new trading opportunities, driven in part by a “search for yield” in the low interest rate environment of the past several years, has meant that cryptoassets are no longer on the fringes of the financial system. This means that policy makers and market regulators will have to find ways to avail of the opportunities and manage risks posed by such assets. This policy brief reviews recent trends, lays out opportunities and risks, and puts forward policy recommendations to reduce risks without unduly stifling innovation. Four main areas for policy action emerge: (i) in the short-term, bring cash- and asset-backed stablecoins under the regulatory umbrella; (ii) in the medium-term, review and update regulations to safeguard financial stability and integrity and harness technology; (iii) strengthen cooperation across sectors and jurisdictions; and (iv) address underlying domestic macroeconomic and structural challenges. As part of their efforts, national authorities should aim to increase the efficiency and inclusiveness of regulated financial services.

The first weeks of May 2022 have seen a reckoning for cryptoassets (digital tokens such as Bitcoin) and so-called “stablecoins” (which aim to peg their value to a specified asset such as the US dollar). Their combined market capitalization fell from $1.85 trillion to $1.34 trillion between May 1st and May 15th, triggered by the collapse of a major stablecoin. This was down from a peak of over $3 trillion in November 2021. The drop in valuation since late 2021 was over twice as sharp as the drop in other financial market indicators, such as the S&P 500. Although there have been large swings in the valuation of cryptoassets in the past, the recent expansion of the crypto ecosystem, along with the growing participation of traditional financial institutions, has increased the financial and economic fallout of such swings and heightened financial stability risks. A growing uptake of new trading opportunities, driven in part by a “search for yield” in the low interest rate environment of the past several years, has meant that cryptoassets are no longer on the fringes of the financial system. This means that policy makers and market regulators will have to find ways to avail of the opportunities and manage risks posed by such assets. This policy brief reviews recent trends, lays out opportunities and risks, and puts forward policy recommendations to reduce risks without unduly stifling innovation. Four main areas for policy action emerge: (i) in the short-term, bring cash- and asset-backed stablecoins under the regulatory umbrella; (ii) in the medium-term, review and update regulations to safeguard financial stability and integrity and harness technology; (iii) strengthen cooperation across sectors and jurisdictions; and (iv) address underlying domestic macroeconomic and structural challenges. As part of their efforts, national authorities should aim to increase the efficiency and inclusiveness of regulated financial services.

1. Trends in cryptoassets and stablecoins

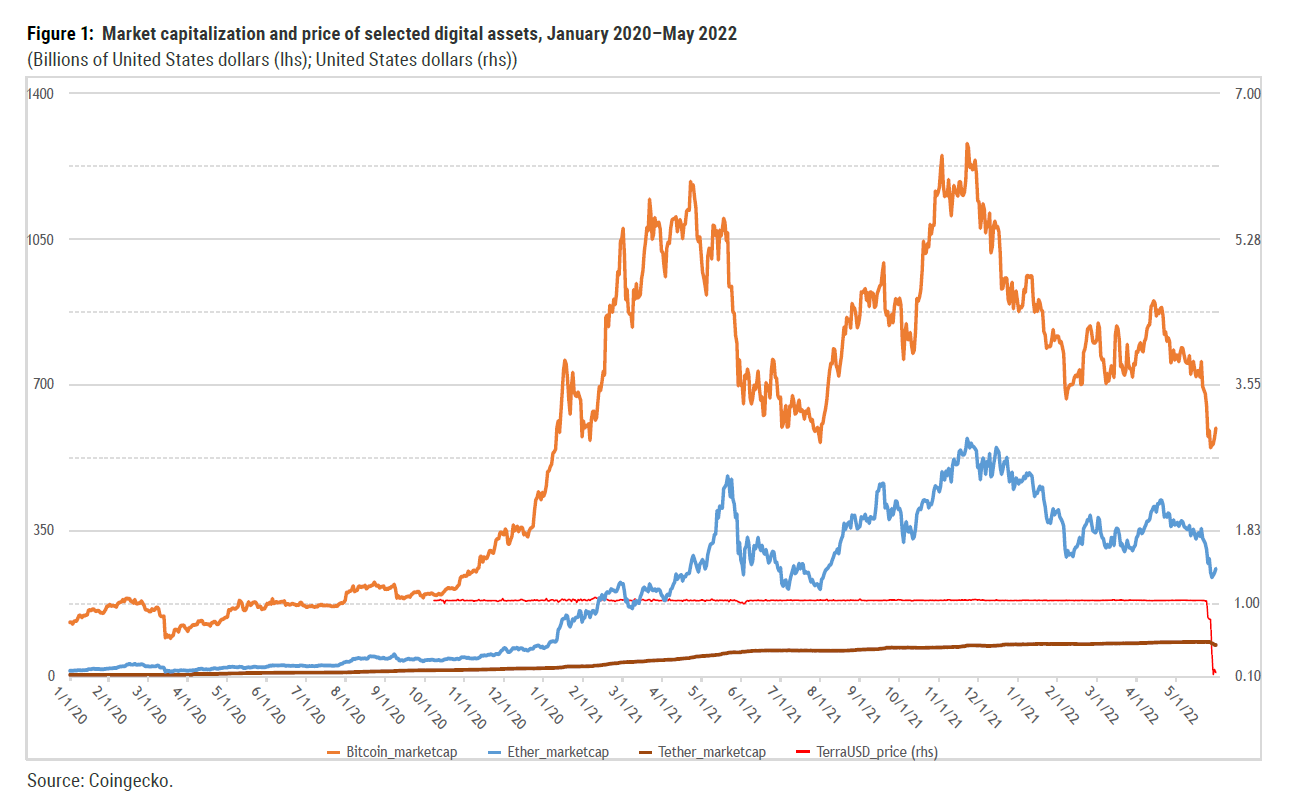

Easy global financing conditions during 2020 and most of 2021 spurred the risk appetite of investors who took advantage of increasing trading opportunities and a growing ecosystem of applications for cryptoassets, causing market capitalization to rise 16-fold between January 2020 and its peak in November 2021. Since then, the first cryptoasset, Bitcoin, which still accounts for over 40 per cent of the total market capitalization, lost over three quarters of its valuation. The fast-growing Ether of the Ethereum blockchain, which currently accounts for just under 20 per cent of total market capitalization, lost over 70 per cent (Figure 1). Stablecoins now make up around 12 per cent of the total, with the largest, Tether, accounting for almost half of that. Yet, Tether also experienced a significant selloff during the first two weeks of May 2022 (see section 2).

2. Cryptoassets remain speculative assets, broader adoption increases risks

Proponents of cryptoassets and so-called “stablecoins” promote their potential to increase the efficiency of financial transactions and make the financial system more inclusive. Some pilot projects aim to support vulnerable populations, such as “Hope for Haiti”, which plans to use a private stablecoin and its associated blockchain to provide cash-based assistance for 150 mothers in its community nutrition programme. Proponents also promote cryptoassets and stablecoins as democratic and decentralized substitutes for official currencies. There are, however, proven alternatives for enhancing payment efficiency and strengthening financial inclusion, such as established digital payment and other financial technology (fintech) services. In addition, around 100 countries are currently exploring the development of central bank digital currencies (CBDC) as one option among others to enhance public payment infrastructures and settlement mechanisms. T he c oncentration o f t he c rypto ecosystemaround a small set of assets dominated by a limited number of major token-holders contradicts claims of democratization and decentralization. Despite recent growth, it will be difficult for privately issued cryptoassets to fulfil the main functions of currencies. First, the large swings in their valuations make cryptoassets unreliable as store of value, unit of account and medium of exchange. In most cases, their growing adoption has been driven by speculative motives and a “fear of missing out” on potential returns. This has, in turn, caused a significant increase in the correlation between cryptoassets and global equity markets in 2020-2021, compared to 2017-2019, and reduced the perceived benefits of diversification. As a result, co-movements and spillovers between crypto and equity markets pose a growing threat to financial stability, especially in countries with more widespread adoption of cryptoassets. Second, a broader adoption of cryptoassets, which is already underway in several developing countries where some residents prefer their use over that of the national currency, risks undermining the effectiveness of national monetary policy – similar to the effects of dollarization. A recent survey found that the top five countries using or owning cryptoassets in 2020 were developing countries, while developed countries were among those with the lowest adoption rates.6 A broader adoption of cryptoassets could also increase the volatility of capital flows, owing to lower transaction costs and the possibility of using cryptoassets to circumvent exchange restrictions and capital flow management measures, among others. Third, the pseudoanonymous nature of cryptoasset transactions also raises concerns about compliance with tax rules and standards on anti–money laundering and combating the financing of terrorism (AML/CFT) – threatening financial integrity and increasing the risk of illicit financial flows. Several countries, including some where cryptoassets are increasingly being used by private actors, are considering the adoption of cryptoassets as legal tender – as El Salvador did with Bitcoin in June 2021 (effective from September 2021), followed by the Central African Republic in April 2022. This creates additional risks for household incomes and savings, tax revenues, the value of reserve holdings, and domestic price stability more broadly. The recent Bitcoin collapse was estimated to have caused around $40 million in losses for El Salvador by mid-May 2022.7 While El Salvador’s official currency has been the US dollar since 2001, the Central African Republic is part of the Central African Economic and Monetary Community (CEMAC), which uses the Central African Franc – pegged to the euro – as a common currency. According to the Bank of Central African States, the adoption of Bitcoin is in violation of CEMAC rules and risks undermining joint monetary policy in the region. At the same time, the expected benefits of using Bitcoin as legal tender to strengthen financial inclusion and reduce the cost of remittances are limited: only around 1/3 and 1/10 of the population of El Salvador and the Central African Republic, respectively, are active Internet users. Another area of concern is the energy intensity and carbon footprint of the distributed ledger technology that underpins cryptoassets, depending on the mechanism used for the validation of transactions. For instance, Bitcoin mining is estimated to use around 125 terawatt-hours per year (more than Norway), with around 70 per cent of that energy coming from non-renewable sources.

3. So-called “stablecoins” had vulnerabilities exposed

While so-called “stablecoins” share many of the characteristics of cryptoassets, including their pseudo-anonymous nature, they have more currency-like features, as they aim to limit volatility by pegging their value to an asset or currency (e.g., the US dollar) or a basket of assets or multiple currencies. They are currently mainly used to facilitate trade between cryptoassets and for the conversion between cryptoassets and currencies, such as the US dollar. The fast growth in decentralized finance applications for trades in cryptoassets and non-fungible tokens (NFT) has led to increased demand and market capitalization of stablecoins, although their use is highly concentrated around a small number of coins. Stablecoins can be vulnerable to runs. Unlike bank deposits in the regulated financial sector, they are not protected by deposit insurance, and their stability relies on trust and on the coverage and liquidity of their underlying assets. Some stablecoins are fully backed by cash or assets that are considered safe and liquid (such as bank deposits and government bonds). Others are backed by assets, such as corporate bonds or commodities, and cash – making them similar to money market funds prior to 2008. Still others are backed by cryptoassets or aim to maintain their peg through algorithms that adjust the supply of tokens according to market conditions. In all cases, a sudden loss of confidence can lead to runs, when investors try to redeem their holdings, possibly triggering rapid sales and price corrections of underlying assets. This risk materialized in early May 2022 with the collapse of TerraUSD – previously one of the top-five stablecoins – which precipitated the rout in cryptoassets during the first two weeks of May 2022. TerraUSD relied on an algorithm to maintain its peg to the US dollar, by linking it to the cryptoasset Luna and using arbitrage mechanisms to maintain a stable value of TerraUSD. The consortium behind both tokens invested over $1.5 billion in Bitcoin, much of which it sold rapidly when market participants lost faith in Luna and sent the price of TerraUSD tumbling. By May 15, the value of Luna had collapsed and the price of TerraUSD had fallen to $0.15 (Figure 1). The shock to investor sentiment and rapid selloffs also caused a temporary drop in the value of Tether, the largest stablecoin by market capitalization, which briefly fell to $0.95 on May 12. Despite quickly recovering its peg to the US dollar, Tether lost almost 10 per cent of its market capitalization between May 1st and May 15th due to large-scale divestments. Investors were able to redeem Tether at par for US dollars, thanks to the asset-based nature of its peg. However, even a fully asset-backed coin that relies on assets such as US government bonds and corporate debt – as Tether reportedly does – could have wider repercussions on financial stability in case of a run, as rapid-fire sales could lead to the devaluation of underlying assets and cause spillovers to more traditional markets. Other, broader uses of stablecoins include applications to make payment transactions more efficient and less costly, including for cross-border transactions including remittances (as one option among others, laid out in the road map for improving crossborder payments developed by the Financial Stability Board). Yet, without appropriate national and international regulatory frameworks, such a widespread use of stablecoins could raise similar risks as cryptoassets, including for financial integrity and stability.

4. Strengthening regulation and supervision in a fast-moving environment

As the crypto ecosystem has expanded into mainstream trading and investing, the May 2022 market rout was a wakeup call for policymakers. The fast growth and cross-border nature of these financial innovations pose important challenges for the stability, integrity, and sustainability of financial markets that need to be addressed. As a first step, national policymakers can build on existing regulation to enhance consumer and investor protection and strengthen the resilience of cash and asset-backed stablecoins. They should review and update, where needed, regulation in line with the recommendations of international standard-setting bodies and continue to cooperate across sectors and jurisdictions to develop a comprehensive, coordinated, and flexible regulatory framework for cryptoassets, including to address illicit financial flows. In some countries, the adoption of cryptoassets and stablecoins by a broader public has been driven by underlying macroeconomic and structural challenges (such as high inflation expectations or an inefficient domestic financial system). These issues should be addressed through appropriate policy reforms.

» Bring cash- and asset-backed stablecoins under the regulatory umbrella

Stablecoins tied to currencies and backed by cash or highly liquid assets have similarities to money held in commercial bank accounts, money market funds, or electronic money. As such, they should be held to the same regulatory standards, according to the principle “same activity, same risk, same rules”. Stablecoins backed by cryptoassets or algorithms are more similar to cryptoassets, which should be reflected in their regulation (see below). Regulatory requirements for issuers of these stablecoins should include: detailed and audited disclosures of their assets; compliance with prudential, financial crime, risk management and governance requirements; and operational and cyber security resilience. If applicable, national regulation should be aligned with recommendations of the Financial Stability Board for the regulation, supervision and oversight of global stablecoin arrangements, and other guidelines from international standard-setting bodies. Where stablecoins become systemically important, or “too big to fail”, they should be subject to similar requirements to systemically important financial institutions.

» Review and update regulations to safeguard financial stability and integrity and harness technology

To mitigate risks from cryptoassets without stifling innovation, national supervisory and regulatory authorities need to closely monitor their use, linkages to the financial system, and potential macroeconomic implications. Legislators and regulators should review and update national regulations, where needed, in line with agreed international standards, including AML/CFT standards and the proposals by the Basel Committee on Banking Supervision on the exposure of banks to cryptoassets. Policymakers should maintain a “technology neutral” approach by regulating activities rather than underlying technologies, while remaining flexible enough to accommodate new technological developments and evolving international standards. Policymakers also have different options to address concerns about the carbon footprint of the underlying digital ledger technology. Proposals include taxing cryptoassets that rely on fossil fuels for the creation (or “mining”) of additional tokens and banning mechanisms that require large and growing amounts of energy and computing power (“proof of work”). Another option could be to include these concerns as part of broader regulations for sustainable financing. While the regulation and supervision of cryptoassets and stablecoins continue to evolve, enhanced education and disclosures of risks can strengthen protection of consumers and investors.

» Strengthen cooperation across sectors and jurisdictions

The broad and global nature of crytoassets and stablecoins requires cooperation of regulators across sectors and borders. Enhanced international cooperation – with the support of international standard-setting bodies – will be needed to create a comprehensive, coordinated regulatory framework that can address spillover risks to the global financial system. This includes continued cross-border cooperation the implementation of the FSB road map for improving cross-border payments, including by enhancing the soundness of stablecoin arrangements for cross-border payments. International cooperation to reduce data gaps (through standardization and data sharing) can help detect fraud and illicit activities and provide early warnings of build-ups of systemic risks. Cross-border coordination of regulations, exchange of information, and enforcement can help minimize regulatory arbitrage and limit the risks of increased capital flow volatility, including from illicit financial flows.

» Address underlying domestic macroeconomic and structural challenges

Where underlying macroeconomic and/or structural challenges are causing large-scale adoption of cryptoassets and stablecoins, policymakers should address these, accompanied by supportive legislative and regulatory action. For instance, where the adoption is driven by weak macroeconomic performance and high inflation expectations, macroeconomic policies and structural reforms should be used to stabilize the macroeconomic environment, while regulatory action can disincentivize the use of non-official currencies. Where the adoption is driven by inefficiencies in the domestic financial system and a lack of access to financial services, policymakers can consider how to improve the functioning and inclusiveness of the financial system, as noted above. Where the main goals are tax and regulatory evasion, this will have to be addressed by stronger and internationally coherent regulation and supervision.

Welcome to the United Nations

Welcome to the United Nations