Download the PDF  The COVID-19 pandemic has inflicted significant damage on global economic activity, exacerbated fiscal challenges worldwide, and impeded countries’ ability to respond to the pandemic and achieve the Sustainable Development Goals (SDGs). Many countries experienced downgrades of their sovereign credit ratings, higher borrowing costs, and intensified risks of debt distress. Developing countries have borne the brunt (over 95%) of credit rating downgrades, despite experiencing relatively milder economic contractions. The fear of ratings downgrades also hindered some countries’ participation in official debt relief programs, such as the G20’s Debt Service Suspension Initiative (DSSI). Three challenges related to developing country sovereign credit ratings stand out: (i) the impact of downgrades on countries’ cost of borrowing and on financial market stability, including whether there is perceived bias, increased volatility, and “cliff effects”; (ii) how official actions, including official debt restructurings such as DSSI, are incorporated into ratings analysis; and (iii) the integration of climate change and other non-economic factors into rating methodologies. These dynamics have led to a renewed focus on the credit rating agencies (CRAs) that determine sovereign ratings. CRAs also garnered attention following the 2008 global financial crisis, when calls for reform included reducing mechanistic reliance on ratings, enhancing competition, and addressing CRA conflicts of interest. Significant regulatory reforms were enacted to help address mechanistic reliance on ratings and try to address the conflicts of interest. Yet, there are still concerns about market concentration, some structural conflicts of interest, and remaining regulatory and investment mandate mechanistic reliance on ratings. There is limited market pressure on CRAs to change their practices as the three largest CRAs (Moody’s, Standard and Poor’s and Fitch) hold over 90 percent of market share. Yet, fast-evolving changes in technology, the growing nature of systemic risks, the impact of the pandemic on access to finance, and the increasingly complex linkages in the financial system have underscored the need to re-evaluate the informational ecosystem supporting sovereign borrowing with a forward-looking approach that reflects a changing world. The current crisis creates an opportunity to do so.

The COVID-19 pandemic has inflicted significant damage on global economic activity, exacerbated fiscal challenges worldwide, and impeded countries’ ability to respond to the pandemic and achieve the Sustainable Development Goals (SDGs). Many countries experienced downgrades of their sovereign credit ratings, higher borrowing costs, and intensified risks of debt distress. Developing countries have borne the brunt (over 95%) of credit rating downgrades, despite experiencing relatively milder economic contractions. The fear of ratings downgrades also hindered some countries’ participation in official debt relief programs, such as the G20’s Debt Service Suspension Initiative (DSSI). Three challenges related to developing country sovereign credit ratings stand out: (i) the impact of downgrades on countries’ cost of borrowing and on financial market stability, including whether there is perceived bias, increased volatility, and “cliff effects”; (ii) how official actions, including official debt restructurings such as DSSI, are incorporated into ratings analysis; and (iii) the integration of climate change and other non-economic factors into rating methodologies. These dynamics have led to a renewed focus on the credit rating agencies (CRAs) that determine sovereign ratings. CRAs also garnered attention following the 2008 global financial crisis, when calls for reform included reducing mechanistic reliance on ratings, enhancing competition, and addressing CRA conflicts of interest. Significant regulatory reforms were enacted to help address mechanistic reliance on ratings and try to address the conflicts of interest. Yet, there are still concerns about market concentration, some structural conflicts of interest, and remaining regulatory and investment mandate mechanistic reliance on ratings. There is limited market pressure on CRAs to change their practices as the three largest CRAs (Moody’s, Standard and Poor’s and Fitch) hold over 90 percent of market share. Yet, fast-evolving changes in technology, the growing nature of systemic risks, the impact of the pandemic on access to finance, and the increasingly complex linkages in the financial system have underscored the need to re-evaluate the informational ecosystem supporting sovereign borrowing with a forward-looking approach that reflects a changing world. The current crisis creates an opportunity to do so.

Challenges experienced by developing countries

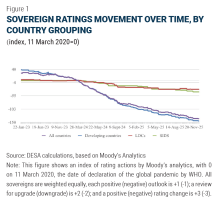

Challenge 1: the impact of credit ratings on a country’s cost of borrowing Credit rating agencies provide information to investors and to financial markets to help them price risk, and thus can directly impact the cost of public investments aimed at delivering sustainable development. In particular, negative warning announcements by CRAs (i.e., “reviews,” “watches,” and “outlooks”) have been linked to increases in the cost of borrowing, particularly for developing countries, at 160 basis points vs. 100 basis points for advanced economies. Valid criticisms of CRAs are not so much that they impact market prices (which would be expected), but whether they transmit inaccurate information and/or exacerbate market reactions and procyclicality. Since sovereign ratings often act as a country-level baseline for corporate ratings, they also affect the cost of corporate borrowing and investment in the SDGs.  Sovereign ratings are structurally different from corporate ratings in that analyst judgement plays a much greater role in sovereign rating decisions. Political risks and “willingness to pay”, which are critical to sovereign credit analysis, are more subjective than corporate rating methodologies. The more subjective nature of sovereign ratings has opened CRAs up to criticisms of potential bias. First, ratings actions during the COVID-19 pandemic revived questions of potential biases against developing countries. Advanced economies received less than 5% of all downgrades (see figure 1), while economic output of the advanced economies contracted at more than twice the pace of output contraction in emerging market and developing economies (-4.7% vs. -2.2%), while also experiencing a significantly greater increase in debt. While this discrepancy could be due to a range of factors, the perception of bias can undermine confidence in ratings’ quality and accuracy, underlining the importance of transparent methodologies. Second, ratings may also be linked to price volatility beyond what would be warranted by market fundamentals due to so-called cliff effects. When securities are downgraded from “investment grade” to “speculative grade” an issuer may face a wave of forced selling of its debt from investors that are not allowed to hold speculative grade debt. Third, ratings can augment capital market volatility and procyclicality (with ratings rising in boom periods and falling during slowdowns), particularly during crises, such as the Asian and Mexican crises in the 1990s, when countries need financing the most. A study that examined 27 African countries between 2007 and 2014 also found that there was an increased probability that Fitch and Moody’s upgraded ratings during boom periods and downgraded them during recessions. Challenge 2: accurately incorporating international cooperation on debt into ratings International cooperation and debt relief programs, such as the DSSI, can help strengthen countries’ balance sheets and ability to repay debt in the medium term. Nonetheless, some developing countries have been deterred from joining these programs, despite elevated debt distress risks, due to the fear that participation in these programs would trigger rating downgrades. If the method of incorporating such programs into ratings discourages participation in a debt relief initiative, this can have a negative impact on a country’s long-term debt sustainability. Challenge 3: incorporating long-term risk factors such as climate risk The current CRA “long-term” rating is meant to cover three to five years for non-investment-grade issuers and up to ten years for investment-grade issuers. In practice sovereign ratings use financial and economic forecasts up to three years, which may over-emphasize near-term economic business cycle expectations. At the same time, the increasing frequency and magnitude of climate and other shocks has highlighted the impact of longer-term factors on a country’s debt sustainability. Amid an increased recognition of the physical and transition risks arising from climate change, CRAs are already integrating climate and other environmental, social and governance (ESG) risks into their ratings. According to Moody’s, 60% of its sovereign credit ratings of developing countries were negatively affected by ESG considerations in 2020. A country’s efforts to invest in the SDGs, including in resilience and climate adaptation, should conversely be viewed favorably in ratings. While financing these investments may increase public debt in the short term, in the long term, resilient and productive investment should stimulate growth, improve resilience, and strengthen countries’ ability to repay. A longer-term outlook is needed to realize this and other positive long-term impacts in ratings.

Sovereign ratings are structurally different from corporate ratings in that analyst judgement plays a much greater role in sovereign rating decisions. Political risks and “willingness to pay”, which are critical to sovereign credit analysis, are more subjective than corporate rating methodologies. The more subjective nature of sovereign ratings has opened CRAs up to criticisms of potential bias. First, ratings actions during the COVID-19 pandemic revived questions of potential biases against developing countries. Advanced economies received less than 5% of all downgrades (see figure 1), while economic output of the advanced economies contracted at more than twice the pace of output contraction in emerging market and developing economies (-4.7% vs. -2.2%), while also experiencing a significantly greater increase in debt. While this discrepancy could be due to a range of factors, the perception of bias can undermine confidence in ratings’ quality and accuracy, underlining the importance of transparent methodologies. Second, ratings may also be linked to price volatility beyond what would be warranted by market fundamentals due to so-called cliff effects. When securities are downgraded from “investment grade” to “speculative grade” an issuer may face a wave of forced selling of its debt from investors that are not allowed to hold speculative grade debt. Third, ratings can augment capital market volatility and procyclicality (with ratings rising in boom periods and falling during slowdowns), particularly during crises, such as the Asian and Mexican crises in the 1990s, when countries need financing the most. A study that examined 27 African countries between 2007 and 2014 also found that there was an increased probability that Fitch and Moody’s upgraded ratings during boom periods and downgraded them during recessions. Challenge 2: accurately incorporating international cooperation on debt into ratings International cooperation and debt relief programs, such as the DSSI, can help strengthen countries’ balance sheets and ability to repay debt in the medium term. Nonetheless, some developing countries have been deterred from joining these programs, despite elevated debt distress risks, due to the fear that participation in these programs would trigger rating downgrades. If the method of incorporating such programs into ratings discourages participation in a debt relief initiative, this can have a negative impact on a country’s long-term debt sustainability. Challenge 3: incorporating long-term risk factors such as climate risk The current CRA “long-term” rating is meant to cover three to five years for non-investment-grade issuers and up to ten years for investment-grade issuers. In practice sovereign ratings use financial and economic forecasts up to three years, which may over-emphasize near-term economic business cycle expectations. At the same time, the increasing frequency and magnitude of climate and other shocks has highlighted the impact of longer-term factors on a country’s debt sustainability. Amid an increased recognition of the physical and transition risks arising from climate change, CRAs are already integrating climate and other environmental, social and governance (ESG) risks into their ratings. According to Moody’s, 60% of its sovereign credit ratings of developing countries were negatively affected by ESG considerations in 2020. A country’s efforts to invest in the SDGs, including in resilience and climate adaptation, should conversely be viewed favorably in ratings. While financing these investments may increase public debt in the short term, in the long term, resilient and productive investment should stimulate growth, improve resilience, and strengthen countries’ ability to repay. A longer-term outlook is needed to realize this and other positive long-term impacts in ratings.

Areas of action and policy solutions

Solutions to these challenges include both voluntary actions and structural reforms. Below are four proposals for immediate action, followed by a reference to additional proposals for structural reforms (see Table 1 for a summary of proposals). 1.Enhance transparency and update ratings methodologies making use of technological innovation First, CRAs should be encouraged to strengthen transparency. While the big three CRAs publish an overview of their methodologies on their websites, many aspects of the methodologies remain opaque, such as the underlying assumptions. Second, a clear distinction between the model-based and discretionary components of ratings can help investors better assess the quality and objectivity of ratings. CRAs could publish the model-based assessments and then superimpose a “qualitative overlay” of analytical judgment. Transparent publication of this process could help address concerns over biased ratings and increase confidence in ratings’ accuracy, while highlighting the value-added of different CRAs. Third, credit assessments should be less about predicting the future than about understanding how well countries respond to risks that are largely unknown, making use of technological innovation. CRAs should be encouraged to incorporate and publish scenario analyses and simulations on debt dynamics under different economic and non-economic assumptions, including climate transition pathways, as a core part of their methodologies. 2.Develop long-term ratings Longer-term ratings, which could be published as a complement to existing assessments, would benefit long-term investors, issuers, and the global community. The use of scenarios for both economic and non-economic risks could make long-term assessments more manageable to produce. If well implemented, long-term sovereign credit ratings could: help investors more reliably gauge their risk exposure; lengthen investment horizons; support the issuance of longer-term bonds; and potentially counteract pro-cyclicality and short-term bias of financial markets. If CRA methodologies incorporate the positive effects of SDG investment, long-term ratings could also create incentives for such investment and help countries raise long-term capital for that purpose. Such ratings would also be better able to capture the positive effects of debt relief programmes, such as the DSSI. 3. Increase dialogue of CRAs with the public sector Dialogue with the public sector could enable a deeper understanding of government policies, especially international official programs. These engagements would not be meant to influence rating decisions, but instead to close any informational gaps CRAs may have about the scope and terms of new initiatives or facilities, which would in turn improve the quality of ratings. This is particularly important when debt relief, debt suspension, or other debt sustainability initiatives, such as the DSSI and the Common Framework, are launched. In addition, the international community could support countries to quickly return to capital markets following a restructuring, working with CRAs. A standing framework for dialogue would also help level the playing field, as compared to current approaches, which can prioritise discussions with larger jurisdictions. 4. Move from a cliff-edge to a graduated approach Regulators, standard setters, investors and CRAs need to work together to soften the cliff-edge dichotomy between investment-grade and below-investment-grade issuers. CRAs themselves do not promulgate the investment-grade cliff, which is an artifact of the regulatory approach since the 1930s. However, CRAs can more explicitly create overlapping tiers of ratings, providing a transitional time when a country’s debt will not necessarily fallout of investment mandates. From the investor side, mandates should be based on the average rating of a portfolio rather than on rating of individual instruments. In the case of a downgrade, this would allow investment managers to maintain a sufficiently high average credit quality without forced selling of specific assets. Regulators could also adopt a more dynamic approach to risk weighting to correspond to a more gradual and graduated categorization of credit ratings to allow a smoother adjustment.

Solutions to these challenges include both voluntary actions and structural reforms. Below are four proposals for immediate action, followed by a reference to additional proposals for structural reforms (see Table 1 for a summary of proposals). 1.Enhance transparency and update ratings methodologies making use of technological innovation First, CRAs should be encouraged to strengthen transparency. While the big three CRAs publish an overview of their methodologies on their websites, many aspects of the methodologies remain opaque, such as the underlying assumptions. Second, a clear distinction between the model-based and discretionary components of ratings can help investors better assess the quality and objectivity of ratings. CRAs could publish the model-based assessments and then superimpose a “qualitative overlay” of analytical judgment. Transparent publication of this process could help address concerns over biased ratings and increase confidence in ratings’ accuracy, while highlighting the value-added of different CRAs. Third, credit assessments should be less about predicting the future than about understanding how well countries respond to risks that are largely unknown, making use of technological innovation. CRAs should be encouraged to incorporate and publish scenario analyses and simulations on debt dynamics under different economic and non-economic assumptions, including climate transition pathways, as a core part of their methodologies. 2.Develop long-term ratings Longer-term ratings, which could be published as a complement to existing assessments, would benefit long-term investors, issuers, and the global community. The use of scenarios for both economic and non-economic risks could make long-term assessments more manageable to produce. If well implemented, long-term sovereign credit ratings could: help investors more reliably gauge their risk exposure; lengthen investment horizons; support the issuance of longer-term bonds; and potentially counteract pro-cyclicality and short-term bias of financial markets. If CRA methodologies incorporate the positive effects of SDG investment, long-term ratings could also create incentives for such investment and help countries raise long-term capital for that purpose. Such ratings would also be better able to capture the positive effects of debt relief programmes, such as the DSSI. 3. Increase dialogue of CRAs with the public sector Dialogue with the public sector could enable a deeper understanding of government policies, especially international official programs. These engagements would not be meant to influence rating decisions, but instead to close any informational gaps CRAs may have about the scope and terms of new initiatives or facilities, which would in turn improve the quality of ratings. This is particularly important when debt relief, debt suspension, or other debt sustainability initiatives, such as the DSSI and the Common Framework, are launched. In addition, the international community could support countries to quickly return to capital markets following a restructuring, working with CRAs. A standing framework for dialogue would also help level the playing field, as compared to current approaches, which can prioritise discussions with larger jurisdictions. 4. Move from a cliff-edge to a graduated approach Regulators, standard setters, investors and CRAs need to work together to soften the cliff-edge dichotomy between investment-grade and below-investment-grade issuers. CRAs themselves do not promulgate the investment-grade cliff, which is an artifact of the regulatory approach since the 1930s. However, CRAs can more explicitly create overlapping tiers of ratings, providing a transitional time when a country’s debt will not necessarily fallout of investment mandates. From the investor side, mandates should be based on the average rating of a portfolio rather than on rating of individual instruments. In the case of a downgrade, this would allow investment managers to maintain a sufficiently high average credit quality without forced selling of specific assets. Regulators could also adopt a more dynamic approach to risk weighting to correspond to a more gradual and graduated categorization of credit ratings to allow a smoother adjustment.

Structural proposals

There are also proposals for structural reforms, such as publicly owned, not-for-profit, or cooperative CRAs to encourage competition and avoid the conflict of interest faced by private CRAs. Public CRAs would, however, also face conflicts of interest, and an open question is whether markets would trust ratings by any new agencies. One option would be for new (or existing) public institutions to develop pure model-based sovereign ratings for all countries, enabling investors to use this as a benchmark to help better distinguish between model-based ratings and value-added judgement inherent in CRA ratings. Indeed, the International Monetary Fund (IMF) already publishes macroeconomic projections for countries. These are not intended as credit assessments, but markets do react to IMF pronouncements.

Conclusion

Fast-evolving changes in technology and the growth of global systemic risks are changing the informational ecosystem around sovereign debt, including for credit ratings. It is in the international community’s interest to ensure that CRAs continue to adapt to these changes in ways that strengthen the quality of ratings and encourage investment in developing countries and in sustainable development. While institutional reforms to CRAs would require political will and strong commitment from the international community, the 4 proposals outlined in this Policy Brief are ripe for action. However, these solutions may not spontaneously manifest. Long-term investors, such as pension funds and insurance companies, can encourage the development of long-term ratings. There may be a role for a private sector group, such as the Global Investors for Sustainable Development (GISD) Alliance, to collectively prompt such changes. International Organizations can also play a role if needed, such as in providing a benchmark to distinguish between model-based ratings and value-added judgement. But political leadership will also be needed to see changes through to conclusion.

Welcome to the United Nations

Welcome to the United Nations