Download the PDF  Since the onset of COVID-19, central banks around the world, in tandem with fiscal authorities, have taken extraordinary measures to mitigate economic fallouts and support recovery. While monetary authorities have generally followed the global financial crisis playbook, the scope, size, and speed of the policy responses to the pandemic have been unprecedented. Since many central banks—especially in developed countries—had less room to reduce interest rates than in 2008, they have relied more heavily on unconventional monetary policy tools to stimulate economic activity, most notably large-scale asset purchases. Central bank purchasing of longer-term financial assets, also known as quantitative easing (QE) was first introduced by the Bank of Japan in 2001 and adopted by other major developed country central banks in response to the global financial crisis in 2008-2009. Large-scale asset purchases were generally effective in stabilizing financial markets during the early phases of the pandemic. At the same time, they supported initial recovery by keeping borrowing costs low, especially for the fiscal authorities. This helped governments to rollout large fiscal stimulus packages, keeping debt servicing costs low in the short run. But the ultra-loose monetary policies—injecting massive liquidity into the financial system—have also contributed to underpricing of risks and sharp increases in asset prices worldwide. Given the large buildup of their balance sheets, major central banks face significant challenges in tapering asset purchases and reverting to conventional monetary policy measures.

Since the onset of COVID-19, central banks around the world, in tandem with fiscal authorities, have taken extraordinary measures to mitigate economic fallouts and support recovery. While monetary authorities have generally followed the global financial crisis playbook, the scope, size, and speed of the policy responses to the pandemic have been unprecedented. Since many central banks—especially in developed countries—had less room to reduce interest rates than in 2008, they have relied more heavily on unconventional monetary policy tools to stimulate economic activity, most notably large-scale asset purchases. Central bank purchasing of longer-term financial assets, also known as quantitative easing (QE) was first introduced by the Bank of Japan in 2001 and adopted by other major developed country central banks in response to the global financial crisis in 2008-2009. Large-scale asset purchases were generally effective in stabilizing financial markets during the early phases of the pandemic. At the same time, they supported initial recovery by keeping borrowing costs low, especially for the fiscal authorities. This helped governments to rollout large fiscal stimulus packages, keeping debt servicing costs low in the short run. But the ultra-loose monetary policies—injecting massive liquidity into the financial system—have also contributed to underpricing of risks and sharp increases in asset prices worldwide. Given the large buildup of their balance sheets, major central banks face significant challenges in tapering asset purchases and reverting to conventional monetary policy measures.

Monetary policy tools used in response to the COVID-19 crisis

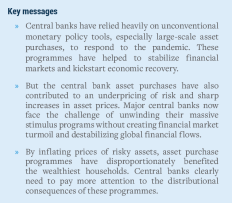

Interest rate measures  Central banks aggressively cut policy rates during the early stages of the pandemic (figure 1). The extent of rate cuts has, however, been much smaller than it was during the global financial crisis, given that interest rates in 2020 were significantly lower than in 2008. In most developed economies—as well as a few developing countries (e.g., Chile, Peru, Thailand)—policy rates hit or came close to the zero-lower bound in 2020. Despite significant interest rate cuts, the interest rate spreads between many developed and developing countries increased during the pandemic, against the backdrop of large capital outflows from emerging and developing economies. Borrowing costs increased for some developing countries, which constrained their ability to rollout sufficiently large fiscal measures. Expanded lending operations Beyond rate cuts, central banks provided short-term liquidity to banks and other financial institutions as the lender of last resort. They also introduced programmes to increase the availability of credit to the non-financial sector. For instance, the ECB’s targeted long-term refinancing operations aimed to encourage bank lending to businesses and consumers in the euro area. The Fed also established new swap lines to maintain foreign exchange market stability. Asset purchase programmes With interest rates at or near the lower bound, bond buying programmes have become the primary stimulus tool for the major developed country central banks. The ultimate objective of these massive programmes—often referred to as quantitative easing (QE)—is to support economic activity by lowering borrowing costs and stimulating credit flows (mortgages, auto loans, consumer loans, etc.) and investment, with a view to boosting employment and economic growth.

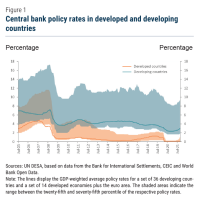

Central banks aggressively cut policy rates during the early stages of the pandemic (figure 1). The extent of rate cuts has, however, been much smaller than it was during the global financial crisis, given that interest rates in 2020 were significantly lower than in 2008. In most developed economies—as well as a few developing countries (e.g., Chile, Peru, Thailand)—policy rates hit or came close to the zero-lower bound in 2020. Despite significant interest rate cuts, the interest rate spreads between many developed and developing countries increased during the pandemic, against the backdrop of large capital outflows from emerging and developing economies. Borrowing costs increased for some developing countries, which constrained their ability to rollout sufficiently large fiscal measures. Expanded lending operations Beyond rate cuts, central banks provided short-term liquidity to banks and other financial institutions as the lender of last resort. They also introduced programmes to increase the availability of credit to the non-financial sector. For instance, the ECB’s targeted long-term refinancing operations aimed to encourage bank lending to businesses and consumers in the euro area. The Fed also established new swap lines to maintain foreign exchange market stability. Asset purchase programmes With interest rates at or near the lower bound, bond buying programmes have become the primary stimulus tool for the major developed country central banks. The ultimate objective of these massive programmes—often referred to as quantitative easing (QE)—is to support economic activity by lowering borrowing costs and stimulating credit flows (mortgages, auto loans, consumer loans, etc.) and investment, with a view to boosting employment and economic growth.  Since the start of the pandemic, the central banks of Japan, the United Kingdom, the United States, and the euro area have added roughly $10.2 trillion in security assets to their already large balance sheets, letting their total assets soar to over $25.9 trillion (as of end-September 2021) (figure 2). The Fed has been buying $120 billion worth of securities every month and has accumulated a total stock of $2.6 trillion in mortgage-backed securities (implicitly guaranteed by the US government) and $5.5 trillion in US Treasury securities. The European Central Bank (ECB) has implemented a €1,850 billion pandemic emergency purchase programme, which complements existing asset purchase programmes (APP) and involves the purchase of both private and public sector securities. The pandemic has marked a turning point for monetary policy in developing countries as many central banks introduced APPs for the first time ever. According to IMF (2021a), a total of 27 central banks—10 in Africa, 9 in Asia, and 8 in Latin America and the Caribbean—announced or implemented APPs over the course of 2020. The programmes were mostly deployed in response to market turmoil in the early stages of the pandemic, when investor panic, rising risk premiums, and substantial capital outflows caused bond prices to fall (and yields to rise) and currencies to depreciate. While most developing country central banks have focused on purchasing public securities denominated in local currencies, several have also included private securities, bank bonds, or even equities (e.g., Egypt). The programmes have been much smaller than in developed countries and of more limited duration. Total asset purchases by most developing country central banks have ranged from just above $0.3 billion to about $30 billion, accounting for 0.3 to 6 per cent of their GDP. By the second quarter of 2021, India was the only major developing economies still engaged in significant purchases.

Since the start of the pandemic, the central banks of Japan, the United Kingdom, the United States, and the euro area have added roughly $10.2 trillion in security assets to their already large balance sheets, letting their total assets soar to over $25.9 trillion (as of end-September 2021) (figure 2). The Fed has been buying $120 billion worth of securities every month and has accumulated a total stock of $2.6 trillion in mortgage-backed securities (implicitly guaranteed by the US government) and $5.5 trillion in US Treasury securities. The European Central Bank (ECB) has implemented a €1,850 billion pandemic emergency purchase programme, which complements existing asset purchase programmes (APP) and involves the purchase of both private and public sector securities. The pandemic has marked a turning point for monetary policy in developing countries as many central banks introduced APPs for the first time ever. According to IMF (2021a), a total of 27 central banks—10 in Africa, 9 in Asia, and 8 in Latin America and the Caribbean—announced or implemented APPs over the course of 2020. The programmes were mostly deployed in response to market turmoil in the early stages of the pandemic, when investor panic, rising risk premiums, and substantial capital outflows caused bond prices to fall (and yields to rise) and currencies to depreciate. While most developing country central banks have focused on purchasing public securities denominated in local currencies, several have also included private securities, bank bonds, or even equities (e.g., Egypt). The programmes have been much smaller than in developed countries and of more limited duration. Total asset purchases by most developing country central banks have ranged from just above $0.3 billion to about $30 billion, accounting for 0.3 to 6 per cent of their GDP. By the second quarter of 2021, India was the only major developing economies still engaged in significant purchases.

What has been achieved by the asset purchase programmes?

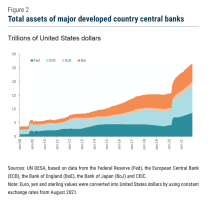

Although it is difficult to disentangle the effects of APPs from those of other monetary policy tools, there is broad consensus that APPs have been an effective tool to increase market liquidity and ease financial conditions in times of severe financial distress and market dysfunction. At the onset of the pandemic and the global financial crisis, developed country central banks’ massive asset purchases mitigated the most adverse feedback loops between financial markets and the real economy. Similarly, the APPs in developing countries appear to have contributed to stabilizing financial markets during the early stages of the pandemic by alleviating market stress. A recent World Bank (2021) study indicates that the novel APPs used by developing country central banks have affected domestic bond yields more strongly than conventional policy rate cuts and developed economies’ QE programmes.  The APPs have generally helped to kickstart the recovery of the real economy by keeping long-term borrowing costs at historically low levels and boosting asset prices. For the US economy, Bernanke (2020) estimated that in 2014 every $500 billion in QE lowered the 10-year treasury yield by 20 basis points. If today’s transmission mechanism resembles the one from 2014, the Fed’s total securities purchases of about $4 trillion suppressed the US treasury yields by as much as 160 basis points. By lowering long-term interest rates, the programmes have also pushed up asset prices, increasing the financial wealth of households and firms and boosting aggregate demand during the stages of the pandemic.

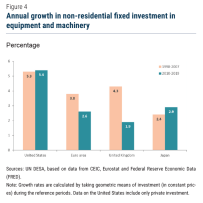

The APPs have generally helped to kickstart the recovery of the real economy by keeping long-term borrowing costs at historically low levels and boosting asset prices. For the US economy, Bernanke (2020) estimated that in 2014 every $500 billion in QE lowered the 10-year treasury yield by 20 basis points. If today’s transmission mechanism resembles the one from 2014, the Fed’s total securities purchases of about $4 trillion suppressed the US treasury yields by as much as 160 basis points. By lowering long-term interest rates, the programmes have also pushed up asset prices, increasing the financial wealth of households and firms and boosting aggregate demand during the stages of the pandemic.  The subdued economic performance of many developed countries since the global financial crisis suggests that the effectiveness of central bank asset purchases can dissipate quickly beyond the crisis phase. When markets are functioning well, APPs appear to have only limited impact on investment, durable consumption, and economic growth. Figure 4 shows that in the euro area and the United Kingdom investment in equipment and machinery grew more slowly in the decade after the global financial crisis than in the previous decade despite central banks’ massive QE programmes. While investment in the United States and Japan has trended upwards, gains have been modest. One factor that has been holding back investment is a massive increase in stock buybacks, especially in the United States. The combination of record-low interest rates and large tax cuts in 2017 pushed buybacks to a new record level prior to the COVID-19 shock. After a pause during the pandemic, firms have resumed their stock buyback activities. In the second quarter of 2021, the Standard and Poor’s 500 buybacks totaled $199 billion (equivalent to about 3.5 per cent of GDP), an increase of 124.3 per cent from the second quarter of 2020 and only 11 per cent below the all-time high of $223 billion in the fourth quarter of 2018. While the large-scale buybacks have been pushing up stock prices, they could negatively affect capital accumulation and reduce firms’ ability to cope with an economic downturn, especially if the buybacks are funded with new borrowing. Moreover, the increases in stock price often just benefit senior corporate executives and major shareholders. Another potential reason why large-scale asset purchases may not have boosted investment as much as expected is a weak bank lending channel. Evidence from QE after the global financial crisis indicates that commercial banks responded to the reserve injection in part by shifting their portfolios into low-risk assets—rather than lending to the real economy—to optimize the use of regulatory capital. Preliminary evidence from the US during the COVID-19 crisis also suggests a limited role of QE via enhanced bank lending. For one, bank lending in 2020 has been limited by financial constraints at the firm level, rather than the bank level as in 2008. Many US banks entered the pandemic crisis in strong financial positions, well capitalized and with ample liquidity. Since QE can mainly relax financial constraints at the bank level (rather than the firm level), it has likely been less effective during the COVID-19 crisis (Sims and Wu, 2020). Similarly, since bank reserves were much larger in 2020 than in 2008, the direct effect of a further increase in bank reserves on the liquidity premium is smaller, reducing the overall effectiveness of QE (Occhino, 2020).

The subdued economic performance of many developed countries since the global financial crisis suggests that the effectiveness of central bank asset purchases can dissipate quickly beyond the crisis phase. When markets are functioning well, APPs appear to have only limited impact on investment, durable consumption, and economic growth. Figure 4 shows that in the euro area and the United Kingdom investment in equipment and machinery grew more slowly in the decade after the global financial crisis than in the previous decade despite central banks’ massive QE programmes. While investment in the United States and Japan has trended upwards, gains have been modest. One factor that has been holding back investment is a massive increase in stock buybacks, especially in the United States. The combination of record-low interest rates and large tax cuts in 2017 pushed buybacks to a new record level prior to the COVID-19 shock. After a pause during the pandemic, firms have resumed their stock buyback activities. In the second quarter of 2021, the Standard and Poor’s 500 buybacks totaled $199 billion (equivalent to about 3.5 per cent of GDP), an increase of 124.3 per cent from the second quarter of 2020 and only 11 per cent below the all-time high of $223 billion in the fourth quarter of 2018. While the large-scale buybacks have been pushing up stock prices, they could negatively affect capital accumulation and reduce firms’ ability to cope with an economic downturn, especially if the buybacks are funded with new borrowing. Moreover, the increases in stock price often just benefit senior corporate executives and major shareholders. Another potential reason why large-scale asset purchases may not have boosted investment as much as expected is a weak bank lending channel. Evidence from QE after the global financial crisis indicates that commercial banks responded to the reserve injection in part by shifting their portfolios into low-risk assets—rather than lending to the real economy—to optimize the use of regulatory capital. Preliminary evidence from the US during the COVID-19 crisis also suggests a limited role of QE via enhanced bank lending. For one, bank lending in 2020 has been limited by financial constraints at the firm level, rather than the bank level as in 2008. Many US banks entered the pandemic crisis in strong financial positions, well capitalized and with ample liquidity. Since QE can mainly relax financial constraints at the bank level (rather than the firm level), it has likely been less effective during the COVID-19 crisis (Sims and Wu, 2020). Similarly, since bank reserves were much larger in 2020 than in 2008, the direct effect of a further increase in bank reserves on the liquidity premium is smaller, reducing the overall effectiveness of QE (Occhino, 2020).

Risks and side effects of sustained asset purchase programmes

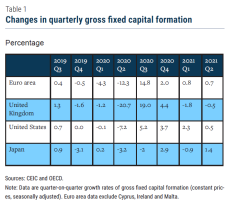

At the same time, the APPs by developed country central banks have created risks that, if not managed well, could undermine global recovery. By providing unprecedented amounts of liquidity via bond purchases, major central banks have contributed to a significant underpricing of risk, inflating asset prices, causing a growing disconnect between financial markets and the real economy, and distorting credit and investment decisions. This has raised macroeconomic and financial stability risks going forward, while also prompting concerns over adverse distributional effects of the policies. While virtually all asset classes have been inflated by the unprecedented monetary policy responses to the pandemic, global equities have seen the strongest price increases. Major stock indices have been breaking all-time high after all-time high even as many economies were struggling to recover from the crisis. Since reaching a trough in March 2020, the Standard and Poor’s 500 index has risen by about 80 per cent and the MSCI Core Europe by nearly 70 per cent. Valuations appear to have become increasingly detached from underlying fundamentals as evidenced by the sharp increase in the cyclically adjusted price-earnings (CAPE) ratio, which measures the relative price of equities by comparing their current price to the average ten-year earnings. For the Standard and Poor’s 500 index, the CAPE ratio has risen by over 50 per cent since April 2020, more than after any other US recession in the past 120 years. As a result, US equity markets rarely seemed more expensive than they are now, with CAPE ratios approaching levels only seen prior to the bursting of the dot-com bubble in 2001. Equity prices have also rebounded elsewhere, but valuations are generally less stretched than in the United States.  All this has spurred fears of ever-expanding asset price bubbles as the disconnect between financial markets and economic fundamentals widens. Table 1 shows that while investment in developed economies bounced back after the collapse in the second quarter of 2020, the upward momentum slowed significantly in the first half of 2021. Instead of a sustained increase in investment, global economic conditions are currently characterized by persistent supply-side bottlenecks, which have been feeding inflationary pressures. If monetary conditions were to shift abruptly—with the Fed taking a more hawkish policy stance—some of the asset price bubbles could burst. Sharp market corrections could trigger a rising number of bankruptcies and cause substantial macroeconomic damage. Furthermore, APPs have had negative distributional effects, especially through the asset price channel. Sharp increases in the prices of financial assets tend to benefit rich households more than other groups. Wealthy individuals invest a much larger share of their total assets in financial assets, especially equities, which have registered the strongest price gains among all asset classes since the beginning of the pandemic. In contrast, less wealthy individuals hold most of their assets in the form of real estate, whose prices often grow at a slower pace. Moreover, many individuals at the bottom of the wealth distribution have almost no assets and thus barely benefit from a general increase in asset prices. In the US, for example, the wealthiest 10 per cent held nearly half of all assets in stocks in 2016, whereas the corresponding figure for the bottom 20 per cent was only 2 per cent (Bonifacio et al., 2021). Assuming that the asset composition for different groups continues to hold, the top 10 per cent in the US are estimated to have recorded wealth gains of about 44 per cent since March 2020, compared to only 15 per cent for the bottom 20 per cent. The impact on wealth inequality is more striking when looking at absolute gains. Between the first quarter of 2020 and the second quarter of 2021, the top 1 per cent US income earners averaged net-wealth gains of about $3.5 million per person, while the bottom 20 per cent recorded only an increase of about $5,300. Evidence from Japan, the United Kingdom and the euro area also suggests that asset purchases have disproportionately benefited wealthy households. Since women tend to have less wealth and income than men—and are less likely to invest in risky assets—APPs are also compounding gender inequalities.

All this has spurred fears of ever-expanding asset price bubbles as the disconnect between financial markets and economic fundamentals widens. Table 1 shows that while investment in developed economies bounced back after the collapse in the second quarter of 2020, the upward momentum slowed significantly in the first half of 2021. Instead of a sustained increase in investment, global economic conditions are currently characterized by persistent supply-side bottlenecks, which have been feeding inflationary pressures. If monetary conditions were to shift abruptly—with the Fed taking a more hawkish policy stance—some of the asset price bubbles could burst. Sharp market corrections could trigger a rising number of bankruptcies and cause substantial macroeconomic damage. Furthermore, APPs have had negative distributional effects, especially through the asset price channel. Sharp increases in the prices of financial assets tend to benefit rich households more than other groups. Wealthy individuals invest a much larger share of their total assets in financial assets, especially equities, which have registered the strongest price gains among all asset classes since the beginning of the pandemic. In contrast, less wealthy individuals hold most of their assets in the form of real estate, whose prices often grow at a slower pace. Moreover, many individuals at the bottom of the wealth distribution have almost no assets and thus barely benefit from a general increase in asset prices. In the US, for example, the wealthiest 10 per cent held nearly half of all assets in stocks in 2016, whereas the corresponding figure for the bottom 20 per cent was only 2 per cent (Bonifacio et al., 2021). Assuming that the asset composition for different groups continues to hold, the top 10 per cent in the US are estimated to have recorded wealth gains of about 44 per cent since March 2020, compared to only 15 per cent for the bottom 20 per cent. The impact on wealth inequality is more striking when looking at absolute gains. Between the first quarter of 2020 and the second quarter of 2021, the top 1 per cent US income earners averaged net-wealth gains of about $3.5 million per person, while the bottom 20 per cent recorded only an increase of about $5,300. Evidence from Japan, the United Kingdom and the euro area also suggests that asset purchases have disproportionately benefited wealthy households. Since women tend to have less wealth and income than men—and are less likely to invest in risky assets—APPs are also compounding gender inequalities.

Key policy challenges that lie ahead

With rising inflationary pressures—average inflation is running well above target in many countries—the developed country central banks, especially the Fed and the ECB, face the difficult challenge of scaling back their bond purchase programmes, without creating financial market turmoil and destabilizing global financial flows. The risk of policy mistakes—either by withdrawing stimulus too fast or by waiting too long with tightening—is substantial. Beyond this immediate challenge, the more fundamental question is if—and if yes, how—central banks will reverse the asset purchases and reduce the size of their balance sheets. Debt-service costs in several developed countries have become more sensitive to short-term interest rates, in part due to QE. If interest rates were to rise more significantly than expected, public finances could come under pressure, especially in countries with high debt burdens, such as Canada, Italy, the United Kingdom, and the United States. In the United States, interest expenses accounted for about 10 per cent of total government revenues in 2020. According to baseline projections, this ratio is forecast to increase to about 14 per cent by 2030. Under a higher interest rate scenario—assuming that the interest rate on 10-year Treasury notes rises to 4 per cent in 2025—interest payments could account for 22 per cent of total revenues in 2030, which could force the US Government to cut back on essential spending. The developed country governments cannot rely on very low interest rates forever to increase and sustain fiscal spending. They must find alternative sources of financing to meet their budgetary needs, which can also help to prevent speculative activities and bubbles in the financial market. Fiscal and macroprudential policies can play a key role in addressing some of the negative macroeconomic and distributional effects of APPs. More progressive taxation of capital gains could, for example, be one lever to offset rising wealth inequalities that result from rapid growth of asset prices. Similarly, taxing corporate stock buybacks may improve both macroeconomic and distributional outcomes. Finally, macroprudential policies and regulations, such as higher minimum down payments requirements or tighter loan-to-value ratio rules, can help prevent overheating of real estate markets.

References

Bernanke, Ben S. (2020). The new tools of monetary policy. American Economic Review, vol. 110, No. 4 (April), pp. 943–983. Bonifacio, Valentina et al. (2021). Distributional effects of monetary policy. IMF Working Paper, No. WP/21/201. Washington, D. C. Occhino, Filippo (2020). Quantitative easing and direct lending in response to the COVID-19 crisis. Federal Reserve Bank of Cleveland Working Paper, No. 20-29 (October). Sims, Eric, and Jing Cynthia Wu (2021). Evaluating central banks’ tool kit: Past, present, and future. Journal of Monetary Economics, vol. 118, March, pp. 135–160. World Bank (2021). Asset purchases in emerging markets – Unconventional policies, unconventional times. In Global Economic Prospects January 2021, chap. 4. Washington, D. C.

Welcome to the United Nations

Welcome to the United Nations