The world economy stumbled in 2015 and only a modest improvement is projected for 2016/17 as a number of cyclical and structural headwinds persist, says the United Nations World Economic Situation and Prospects (WESP) 2016 report.

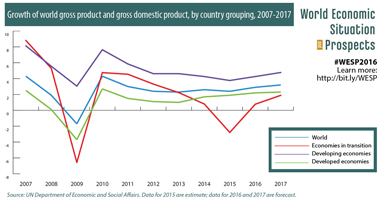

Global growth is estimated at a mere 2.4 per cent in 2015, marking a downward revision by 0.4 percentage points from the UN forecasts presented six months ago. Amid lower commodity prices, large capital outflows and increased financial market volatility, growth in developing and transition economies has slowed to its weakest pace since the global financial crisis of 2008/2009.

Given the much anticipated slowdown in China and persistently weak economic performances in other large emerging economies, notably the Russian Federation and Brazil, the pivot of global growth is partially shifting again towards developed economies.

The world economy is projected to grow by 2.9 per cent in 2016 and 3.2 per cent in 2017, supported by generally less restrictive fiscal and still accommodative monetary policy stances worldwide.

The world economy is projected to grow by 2.9 per cent in 2016 and 3.2 per cent in 2017, supported by generally less restrictive fiscal and still accommodative monetary policy stances worldwide.

The anticipated timing and pace of normalization of the US monetary policy stance is expected to reduce policy uncertainties and support a moderate pickup in investments and growth, while preventing excessive volatility in financial markets and ensuring an orderly adjustment in asset prices.

The improvement is also predicated on the stabilization of commodity prices and no further escalation in geo-political conflicts during the forecast period.

“Stronger and more coordinated policy efforts are needed to ensure robust, inclusive and sustainable economic growth, which will be a key determinant for achieving the 2030 Sustainable Development Goals,” noted Lenni Montiel, Assistant Secretary-General of the United Nations Department of Economic and Social Affairs.

Five major headwinds for global economyThe WESP report identifies five major headwinds for the global economy: 1. persistent macroeconomic uncertainties; 2. low commodity prices and diminished trade flows; 3. rising volatility in exchange rates and capital flows; 4. stagnant investment and productivity growth; and 5. continued disconnect between finance and real sector activities.

The weakness in growth is also adversely impacting labour markets in many developing and transition economies. Unemployment is on the rise, especially in South America, or remains stubbornly high, such as in South Africa. At the same time, job insecurity is often becoming more entrenched amid a shift from salaried work to self-employment.

With persistent output gaps, modest wage growth and lower commodity prices, global inflation is at its lowest level since 2009. Deflation risks in developed economies have diminished, but not disappeared, particularly in Japan and the euro area.

Growth in developed economies will gain some momentum in 2016, surpassing the 2 per cent mark for the first time since 2010, the report notes. Economic growth in developing and transition economies is expected to bottom out and gradually recover, but the external environment will continue to be challenging and growth will remain well below its potential.

Economic growth and financial stability

The report indicates that the challenges for policymakers around the globe are likely to intensify in the short run in view of the weaknesses in the world economy and difficult trade-offs in the areas of monetary, fiscal and exchange rate policies.

The report underscores that monetary authorities would need to make concerted efforts to reduce uncertainty and financial volatility, striking a delicate balance between their economic growth and financial stability objectives. “The expected timing and pace of normalization of the US monetary policy will help reduce some policy uncertainties and provide impetus to revive investment,” Hamid Rashid, Chief of the UN’s Global Economic Monitoring Unit added, while presenting the report.

Given the massive build-up of private debt in many emerging economies, policymakers would need to fine-tune their policy mix – more active fiscal policies, macro-prudential instruments, targeted labour market policies, among others – amid volatile global financial conditions.

The report highlights that monetary policies did most of the heavy-lifting since the global crisis to support growth but the time has come for fiscal policies to play a greater role. Well-designed and targeted labour market strategies are needed to complement fiscal policies to re-invigorate productivity, employment generation and output growth.

Global growth, environmental sustainability and poverty reduction

The report also shares some positive recent trends in environmental sustainability. Global energy-related carbon emissions experienced no growth in 2014 for the first time in 20 years, with the exception of 2009 when the global economy contracted. This suggests the possibility that the world might start to see some de-linking between economic growth and carbon emission growth.

At the same time, the report warns that the broad slowdown in economic growth in many developing economies could restrain progress in poverty reduction in the near term and derail long-term sustainable development. To avert such a scenario and stimulate inclusive growth, more effective policy coordination – at the national, regional and global level – is needed. Further progress in poverty reduction could come from policy interventions that also address inequality, such as investment in education, health and infrastructure, and stronger social safety nets.

Welcome to the United Nations

Welcome to the United Nations